Understanding W.D. Gann's Approach to Time Cycles and Price Culminations

#168 An update on the US Indices: DJIA, S&P500, Nasdaq

Introduction

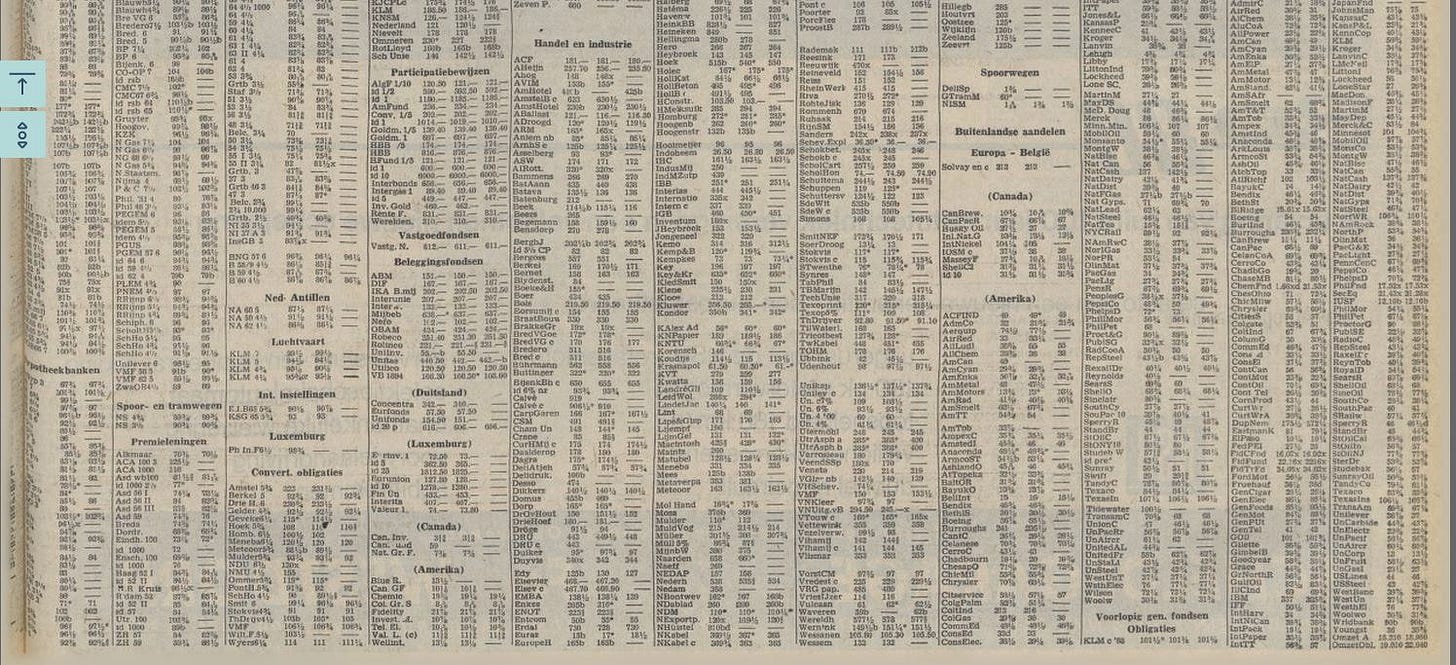

When I was 10 years old, I made my first trade in a bicycle factory. I had been reading the financial section of my local newspaper (see below image) and noticed a trend in the company's stock that was rapidly evolving day after day. With my father's permission, I decided to pool all my pocket money together and buy some shares in the company. Within a few months, the stock skyrocketed and I made a profit of 2600% by selling my shares at the peak of the trend. This experience sparked my interest in the stock market, and I became fascinated by what caused its fluctuations. I knew there was something out there that influenced the stock market, and this set me on a lifelong journey to understand its workings, a journey that continues to this day.

Throughout my journey, I have learned from respected traders and analysts such as Benjamin Graham, Stan Weinstein, Thomas N. Bulkowski, J.M. Hurst, Raymond Merriman, Robert Prechter, Bradley Cowan, M.S. Jenkins, Daniel T. Ferrera, and W.D. Gann. Through their teachings, I have learned about fundamental and technical analysis, cycle analysis, Elliott Wave analysis, financial astrology, and Gann analysis techniques.

It's important to note that there's no one-size-fits-all approach to trading or investing in the stock market. The experts I've learned from have used multiple methods to be successful in the markets. Although there's no holy grail when it comes to trading and investing, learning from and applying a variety of techniques can help traders and investors gain a better understanding of the market and improve their chances of success.

Cycle analysis has taught me that there are no fixed cycles that always come to a trough or crest in an exact, repetitive, and timely fashion. It’s like our own daily cycle in life. I do not always exactly wake up at the same time, have lunch or dinner, or go to bed at the same time. Permanent cycles, like the 20-year or 60-year cycle I follow, have a specific range in which they peak or bottom out, but their actual length can vary by up to one-third of the total length. These cycles can sometimes expand, contract, or invert, and some cycles are more susceptible to these changes than others.

From W.D. Gann, I have learned that permanent cycles may peak and bottom only at certain times, as he clearly mentioned in his Stock Market Course:

“Now, by a study of the TIME PERIODS and TIME CYCLES, you will learn why tops and bottoms are formed at certain times and why Resistance Levels are so strong at certain times and bottoms and tops hold around them.”

To understand where the market is going, you need to understand where the cycle came from.

“The ancient hunters had a rule that when they were searching to locate an animal in his den, they always followed his tracks backward, figuring that it was the shortest route to his lair. The quickest way for you to learn how to determine future market movements is to study the past."

He also said you need to use specific mathematical points of price culmination in his Master Egg Course (1949):

“…but remember you must always begin to count time in days, weeks and months from the extreme high and extreme low levels, and not from exact seasonal or calendar time periods"

In the nine mathematical points1, W.D. Gann showed different techniques he used to analyze the market's position in price and time.

I strongly believe you need to truly understand the depth and width of the above quotes. This is also the key to understanding why Gann Mass Pressure charts (made popular by Daniel T. Ferrera in his book W.D. Gann’s Mass Pressure Forecasting Charts), which plot a composite cycle of 80, 60, 40, 30, 20, and 10 years ago as a forecast, may only work at certain times and, at other times, are off track.

Over the years, I have found the 60-year, 3x the approximate 20-year synodic cycle of Jupiter-Saturn to be the most consistent, but it can be inverted from time to time, like last year. Recently, as you can see in today’s update, this cycle has been catching up with time and price.

In today’s update on the US Indices, I will show you some of W.D. Gann’s nine mathematical points that could be used to understand today’s market, such as looking at the monthly chart, using odd and even squares, time cycles, and time periods, and squaring out price with time from tops and bottoms.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.

Disclosure: No positions at the time of writing.