Gann Master Cycle updates - May 5 2023

Sell in May and go away? - An update on the $DJIA, $SPX and $COMPX

Introduction

In my recent analysis, I examined the use of planetary lines and Gann techniques to forecast future patterns in the US stock market. I started by discussing how W.D. Gann's knowledge of ancient (biblical) cycles and astrology allowed him to forecast trends using planetary angles and trendlines accurately. I then went on to show how we can use these same techniques to identify potential points of resistance and support in the market.

A common saying in finance called "Sell in May and go away” based on an investment strategy for stocks suggests that the stock market underperforms in the six-month period between May and October, compared with the other half of the year. The idea is that investors buy stocks represented by the Dow Jones Industrial Average (DJIA) from November to April and switch to fixed income the other six months, which would produce reliable returns with reduced risk since 1950, according to the Stock Trader's Almanac. Note: The original phrase, "Sell in May and go away, come back on St. Leger's Day." originates from the London Financial District.1

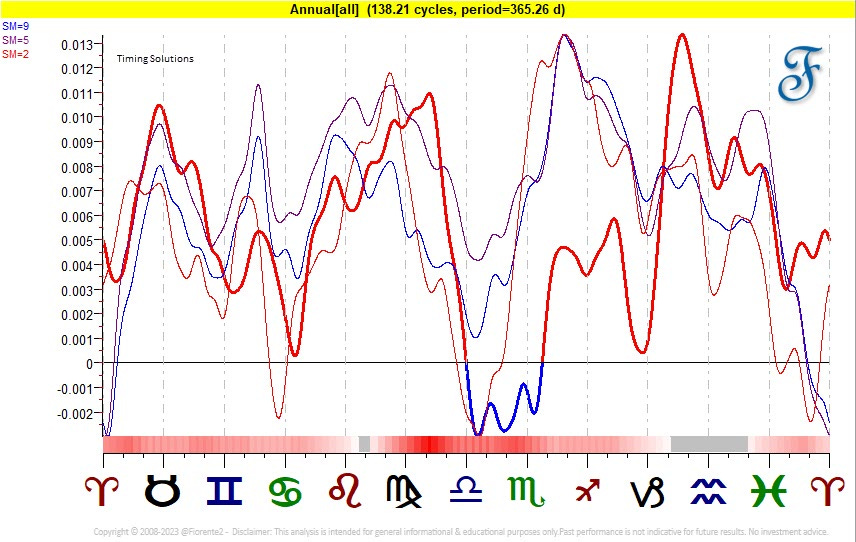

You can see this clearly in the below chart made with Timing Solutions software. There is a seasonality in the stock market, analyzing 138 years of data on the DJIA.

The US Indices are struggling to surpass this year’s high, but it may be too soon to conclude if the markets are already turning based on this strategy. In the last two weeks, I have made clear to my premium subscribers that time may not be up yet as some larger cycles are unfolding in May this year.

Our premium subscribers can read this week’s updates on the DJIA and the SPX following the Gann Master Cycles.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.