Gann Master Cycle - Oct 14 2022

$DJIA, $SPX and $COMPX following the Gann Master Cycles

Introduction

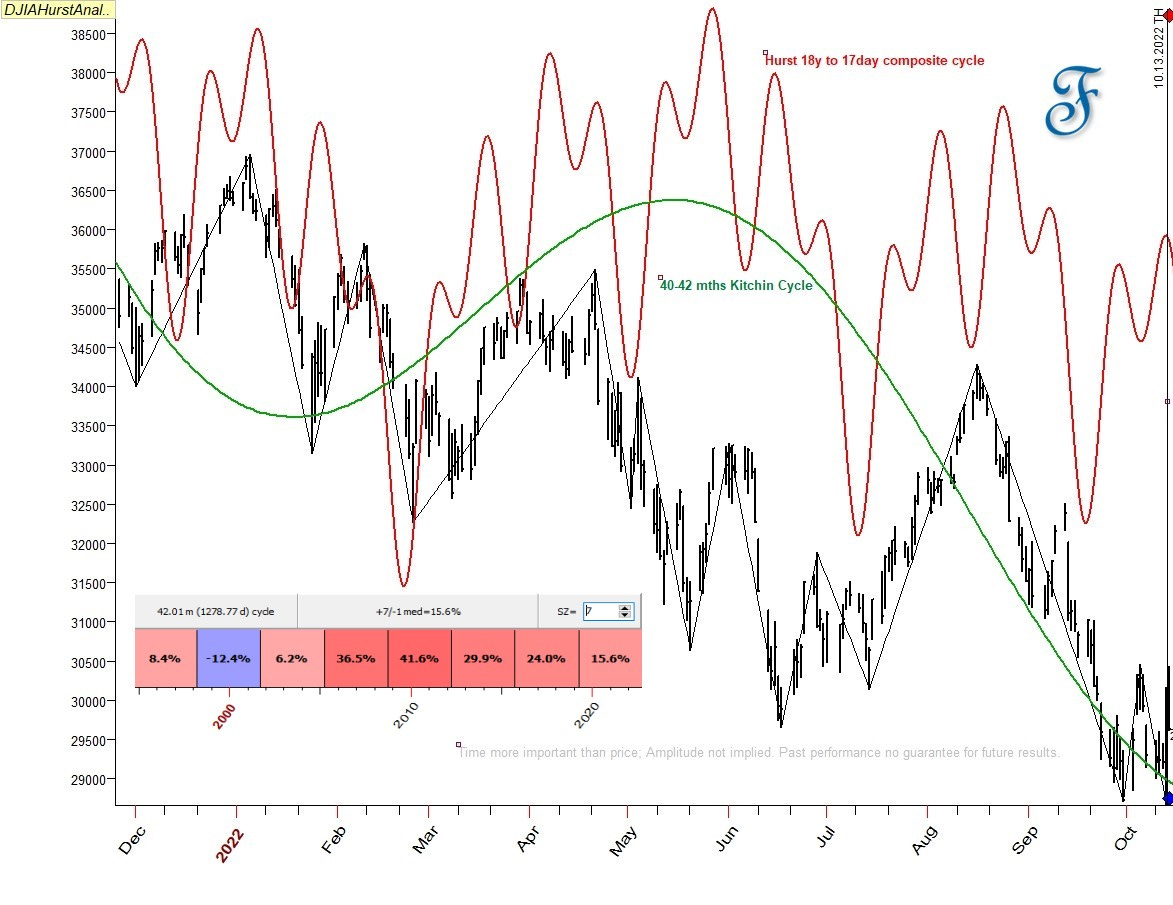

Preparing this week’s post I was looking at the 40-42 months Kitchen cycle which Kitchin discovered in 1923.1 This cycle was earlier discovered in 1912 by the famous wine and bankers family Rothschilds in 1912 according to Edward R. Dewey from the Foundation for the Study of Cycles in his book ‘Cycles: The Mysterious Forces that Trigger Events’.

This cycle has an average length of 40-42 months, as cycles can contract, extend and invert. Currently this cycle is now closer to a cycle of 42 months from trough to trough.

In the last 7 instances the Kitchin cycle has been pretty consistent. In the above chart I have added the static Hurst composite cycle which consists of harmonics of the 18-year nominal Hurst cycle.

Also W.D. Gann recognised in his Stock Market Course the existence of the 42 months cycle. He mentioned:

“You should watch 7 years from any important top and bottom. 42 months or one-half of this cycle is very important. You will find many combinations around the 42nd months. 21 months or 1/4 of this cycle is also important. The fact that some stocks make top or bottom 10-11 months from the previous top or bottom is due to the fact that this period is 1/8 of the 7-year cycle.

There is an 84-year cycle, which is 12 times the 7-year cycle, that is very important to watch.” W.D. Gann Stock Market Course

At important lows many cycles in the Stock Market align on a trough at the same time. Are the permanent cycles aligning? Perhaps these cycles and the 60-year Gann Master Cycle and its harmonics are now coming together in the next few weeks for at least a temporary trough.

The paid subscribers can read further from here on the above analysis in more detail and where we expect possible support in the next few weeks. In this post you also find the latest Gann Master Cycle dynamic updates for the DJIA, the S&P 500 and the 49-year cycle on the Nasdaq Composite. I also included the full chart of the above chart on the Kitchin and Hurst composite cycles. You can review an updated list of stocks from the S&P100 which stocks may have a cyclical turn in the next few weeks in this post as well.

Hypothetical or simulated performance based on past cycles have many limitations. Cycles can contract, extend and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Read our disclaimer.