Echoes of the Past: Past Patterns Unfolding Future Trends

#257 An update on the main trends in the US Indices: S&P 500, Nasdaq 100, and DJIA.

Introduction

Understanding historical patterns can provide invaluable insights into future trends. Last week, a premium subscriber asked why my bias was for the 99-year nominal cycle over the 60-year cycle to understand where we are in today’s market.

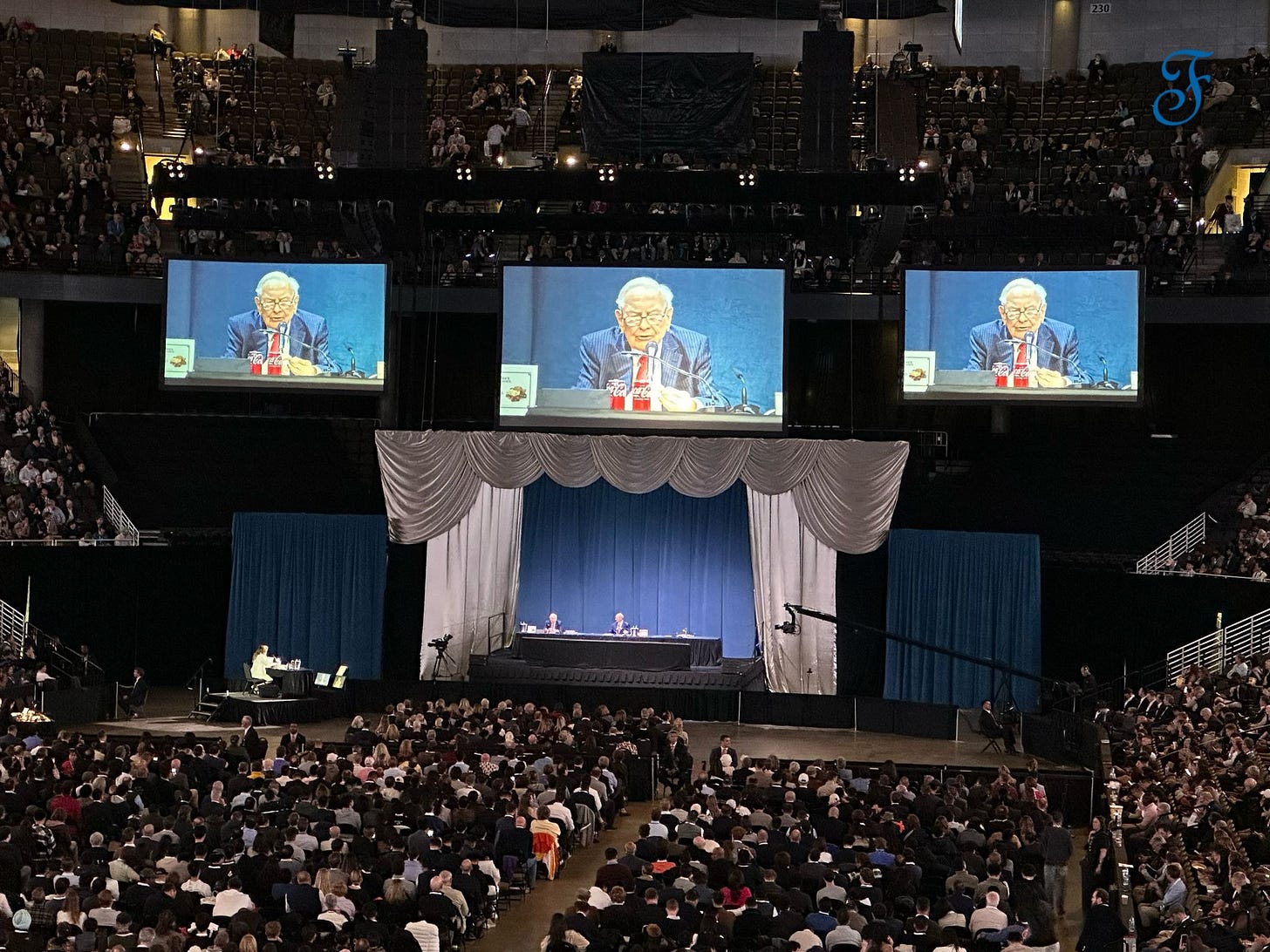

In 60-years' time, a new ‘life - cycle’ starts. So, after running Berkshire Hathaway for 60 years, Warren Buffett announced yesterday that he will step down later this year.

As the saying goes, “History doesn’t repeat itself, but it often rhymes.” They are echoes from the past. Sometimes, the opposite will occur.

To understand which cycle is more representative of today’s market. I explore current and past themes in today’s market, particularly the parallels between 1926, 1965, and today. I also analyze the correlation between past and current market performances. A higher correlation with the 99-year cycle does not indicate that the 60-year cycle may no longer apply.

Similar themes that happened 60 years ago apply today, but may have come in early. Hence, I adjusted the 60-year cycle’s 1965 May-June decline (inflation fears) to February-April 2025 (inflation fears), on which the adjustment shows a similar reaction of investors in today’s market. The recent decline just came in early.

However, in the last few months, the 99-year cycle analog demonstrates an even greater correlation based on exact calendar days. Analogs help to understand past investor reactions. However, they are not precise and should not be relied upon solely. At some point in time, analogs may cease to function.

Examining planetary cycles is more accurate. So, I always look back to see if there are planetary patterns that can explain the analog unfolding.

Our concept of time is relative, differing from measurements based on planetary cycles. Historically, our ancestors closely aligned with nature, observing celestial bodies to mark time. Nowadays, many have lost this connection, perceiving time primarily through constructs like 365-day years instead of the Earth’s true orbital period. This practical approach lacks precision, exemplified by leap years that realign our clocks with nature.

It's important to note that, for example, looking back 60 years (based on 3x the Jupiter-Saturn cycle, nominal 20 years) is imprecise. The exact cycle is 19.85870 years.

Although similar themes may apply today, and the seven planets after which our weekdays are named return to their zodiac positions approximately every 60 years, retrograde movements may not have mirrored those from 60 years ago, leading to discrepancies. There can be differences in declination and planetary speed as well. Therefore, the 60-year analog may not always fit perfectly, and the concept of “As above, so below” may have diverged from the past.

In today’s post, I update last week’s 99- and 60-year cycles chart along with the revised breakout and reversal levels for World Indices. In the coming months, I will focus on planetary cycles or patterns based on ancient laws that repeat over time. These cycles help uncover potential inflection points where the stock market could turn or continue on its trend.

In this post, I will demonstrate to the premium subscribers that the April 2025 low can be explained by the 666-day cycle involving Mars. Next week, another echo from the past involving Mercury may reveal a similar pattern as seen previously, and future inflection points are identified where the markets changed by passing over sensitive planetary points.