Did The Bull Market Reached Its Top?

#289 An Update On DJ Transportation, DJIA, NVDA,AAPL,GOOGL,MSFT and AMZN

Introduction

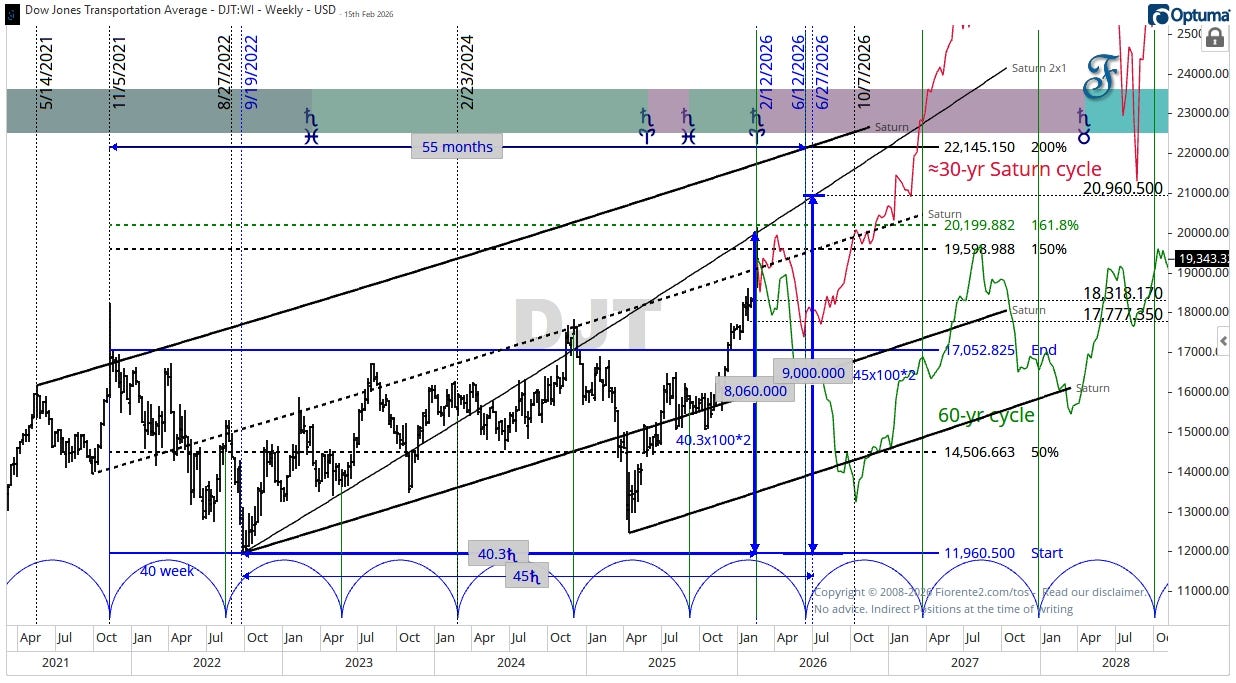

Last week, the stock market experienced several short-term panics, but it continued even after the third Hindenburg Omen occurred on 5 February. This may indicate trouble ahead, and the sudden decline in the DJ Transport Index a week later (due to fears about artificial intelligence job losses) often suggests that fewer goods are being transported and that the economy might be slowing down.

You can read about the Hindenburg Omen here: Ominous ‘Hindenburg Omen’ spotted in U.S. stock market.

This may be a first warning, and as the DJ Transportation index has ‘panicked’ around the 60-year cycle high on the same date as the previous cycle in 1966, it is good to be careful.

The 60-year cycle is known to contract and expand from time to time due to retrograde movements of various planets by up to 8 months. We need to see what will happen in the next few weeks. The approximately 30-year Saturn cycle may invert around June 2026, giving the index some room to move higher until the end of June 2026. This is then a Fibonacci 55 months from the November 2021 high.

In this post, I will analyze the latest report on the DJIA and the top 5 stocks by market capitalization. I will demonstrate, using various charts, how to identify inflection points at which the market might turn using Saturn timing lines.

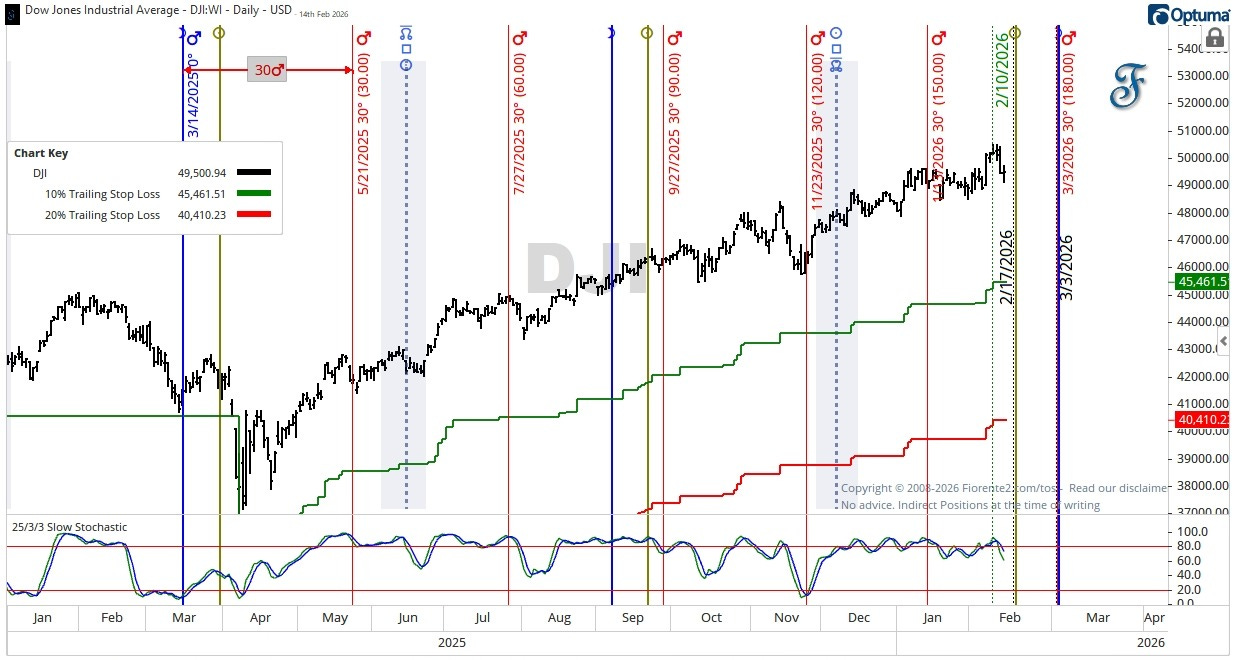

DJIA

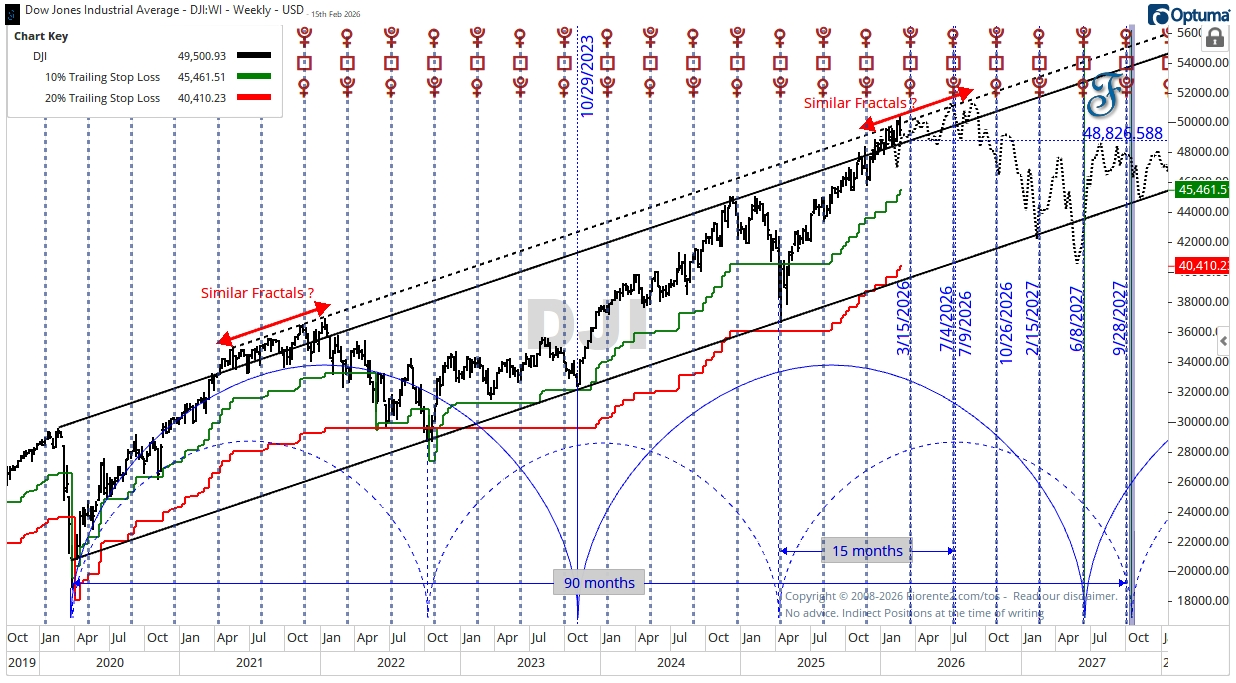

Last time I wrote: “The economy and the stock market are showing strong resilience. I can’t see the US administration allowing the stock market to drop to a July 4th low during a 250-year celebration of the USA’s Independence. Therefore, I am considering an alternative scenario”. I have updated the chart from the last post below:

Long-term cycles we studied earlier typically deviate up to eight months. So, the stock market may trade higher into July 4th, 2026. I projected the 2021/2022 fractal approximately 4.5 years ago for reference.

Even if the stock market experiences a 20% decline (red) from its recent all-time highs, it may still maintain the long-term trend. The 10% drop (green) may likely be the first phase of a major decline.

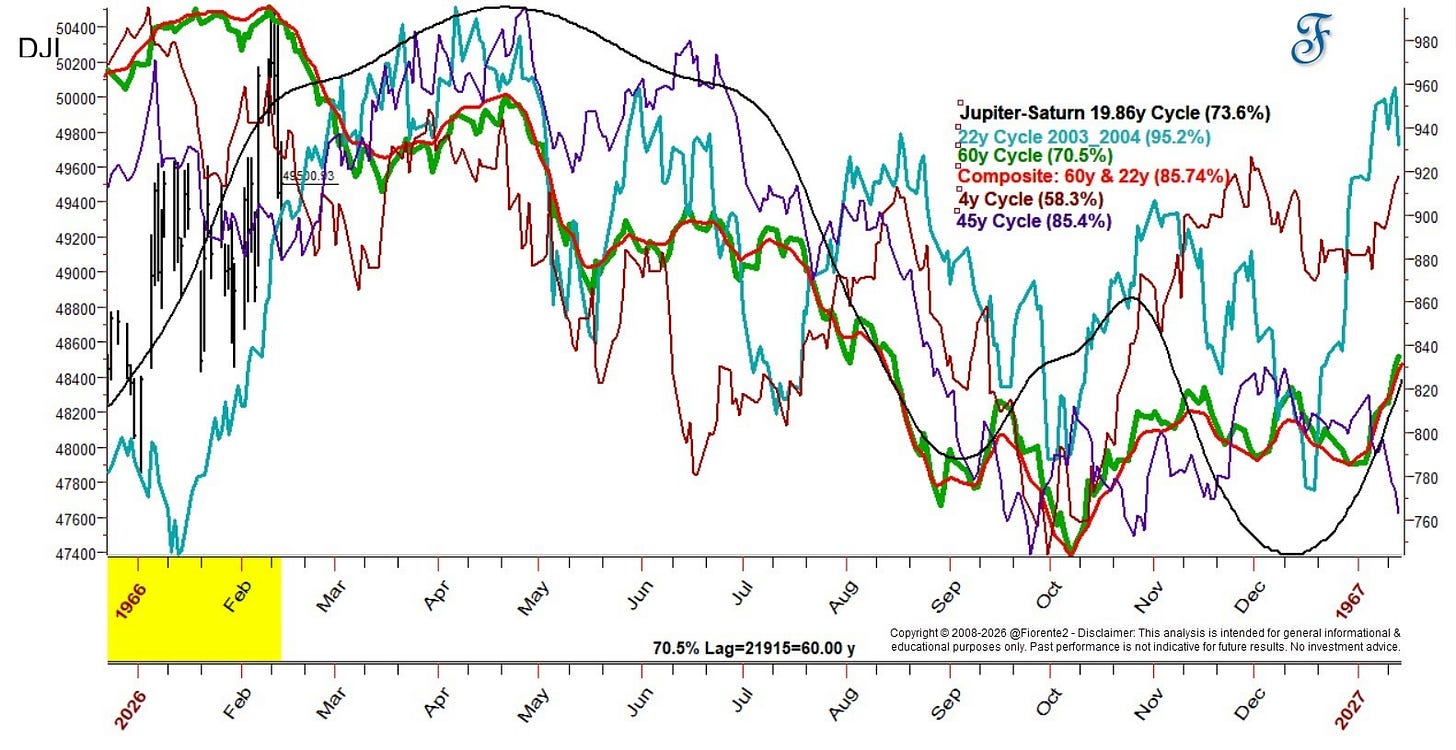

Multiple cycle scenarios

This is just one of the possible scenarios. In the chart below, you will find 5 scenarios that still have a high correlation with today’s market. The 60-, 45-, 22-, 19.86-, and 4-year cycles are plotted on the DJIA chart.

Note that the plotted cycles are overlaid and do not imply a similar decline as suggested on the chart. Time is more important than price.

As shown in the chart above, the 60-year cycle reached a peak exactly 60 years ago. It is too early to conclude that the year’s expected high has been set. The almost 20-year Jupiter-Saturn cycle, which is 1/3 of the 60-year cycle, and the 45-year cycle, which is a harmonic of the 90-year cycle, all made a high later in the year.

An interesting note about the 60-year cycle is that 60 years ago, there was also a midterm election. The Democrats were in power that year but lost the midterm elections to the Republicans. This year, the Polymarket already shows it might be inverse again.

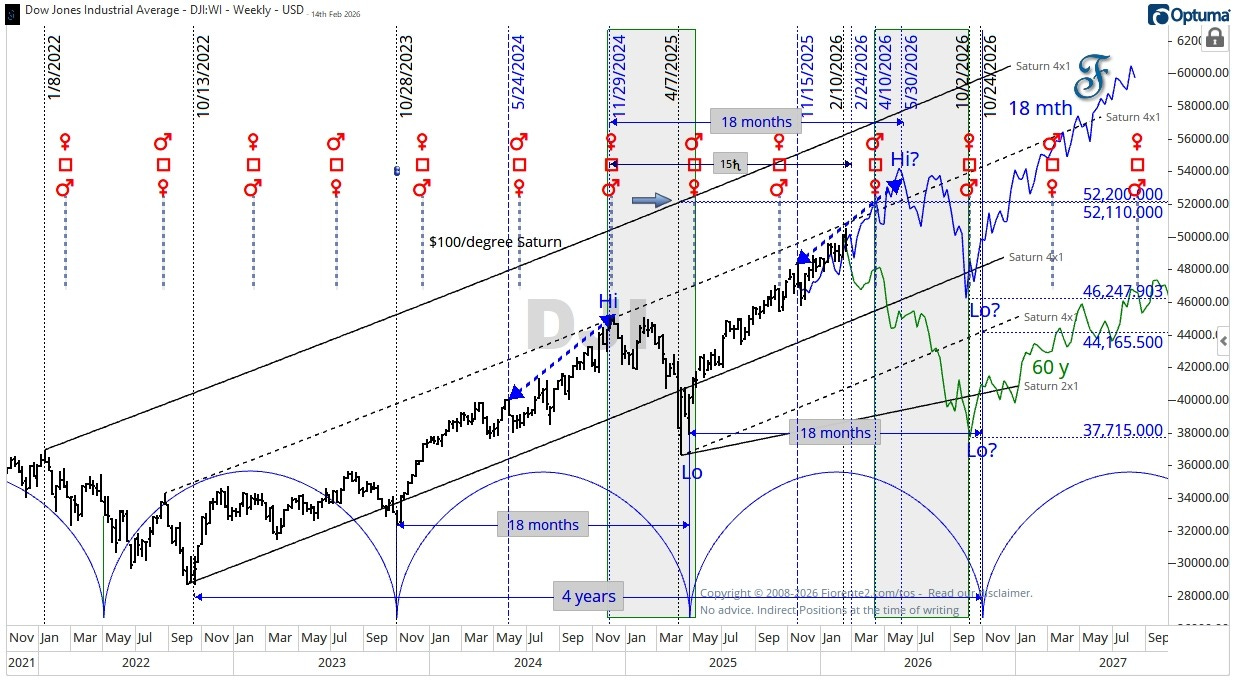

18-month cycle

In the chart below, I have plotted the 18-month cycle alongside the 60-year cycle. This is an important cycle identified by Jim Hurst.

The Venus Square Pluto cycle plotted in the chart above is notable, as it may align with recent highs and lows in the 18-month cycle.

The above scenario aligns with a potential high around May-June 2026, based on the 18-month cycle, and a low in October 2026, with the 60-year and 4-year cycles expected to make lows, alongside multiple other cycles (mentioned earlier).

Solar and lunar eclipse

In the next few weeks, we are approaching solar (02/17/2026) and lunar (3/3/2026) eclipses. There is often considerable volatility around these dates. Monitor the market for turning points shortly before and after a solar eclipse.

In the chart above, I also plotted Mars at 30 degrees from the March Lunar eclipse onward. Often, you will see great inflection points on the 30-degree increments of Mars.

Summary DJIA

My bias is that it may take some time for the market to reach a low. Many cycles could trigger a decline. We may already have set the high on February 11th, 2026, just as 60-years ago. However, other cycles still indicate a potential mid-year high. A high may be set by as early as today or as late as July 2026.

Let’s now have a look at how the magnificent 5 are doing.

The Magnificent 5

Following the magnificent 5 by market capitalization: NVDA, AAPL, GOOGL, MSFT, and AMZN, one can clearly see that the stock market remained resilient despite the declines in these stocks. It shows that market makers, while trading down potentially overbought stocks, are balancing the indices by buying other stocks to maintain recent highs. This may continue for some time until the music stops, and the buying frenzy shifts into more widespread selling across equities.

In the charts below, I have used Saturn timing lines plotted from key highs and lows to indicate potential inflection points. When price and time align (an equal move in price and time), a change in trend (or inversely) may occur. Drawing similar lines from the recent crest may indicate where future inflection points can be expected on the crossroads of other timing lines.

Why did I use Saturn timing lines? In Roman mythology, Chronos or Kronos is identified with the god Saturn, who is known for governing and passing of time, and often called father ‘time’.

Saturn moves roughly 1 degree per month. On a monthly chart, you could draw a 1x1 line, which is reasonably accurate, but on a weekly and daily chart, it is better to measure the exact number of degrees how far Saturn has moved since the start than using a calendar day count.

In all charts, I have added a fair value for each stock based on the Forward Price-to-Earnings Ratio and the 12-month trailing diluted Earnings per Share (EPS), which may indicate the current fair value. This does not include the expected EPS growth for 2026. There are other valuation methods, such as the Discounted Cash Flow methodology, that may give higher forecasts. I find the PE fair value often a more prudent methodology.

The upcoming earnings date is also marked in pink on each chart.

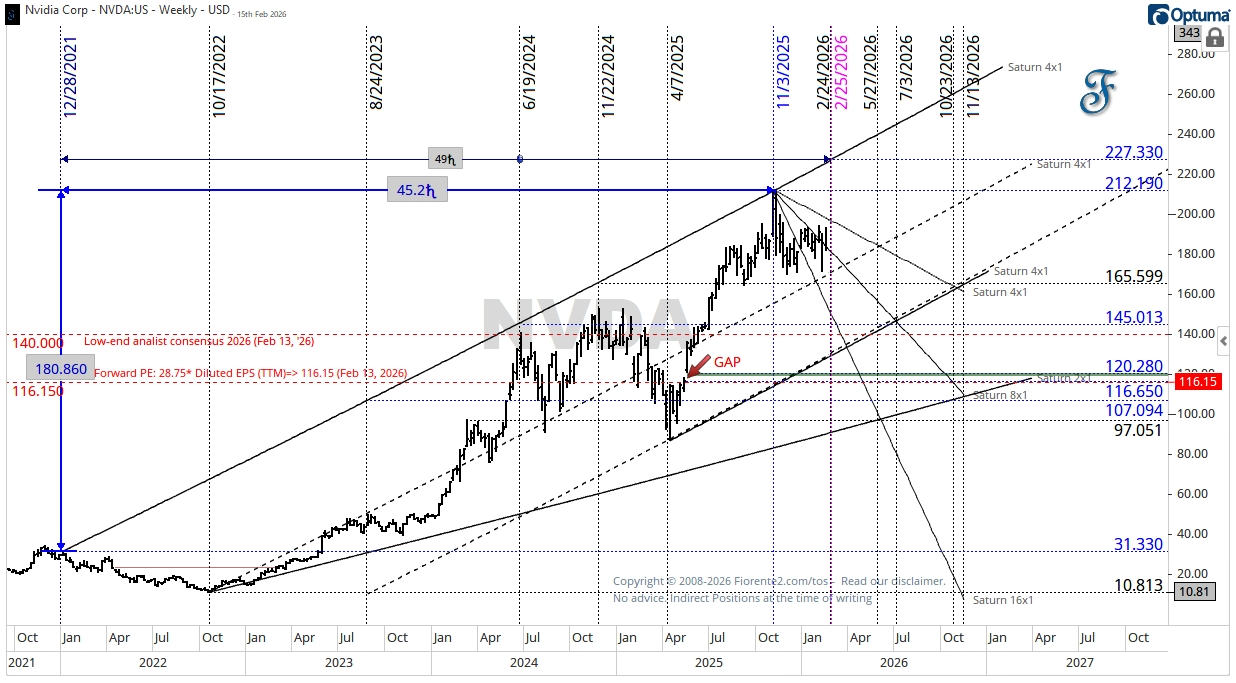

NVDA - NVIDIA Corporation

As shown in the chart below, on a 4x1 Saturn timing line, Price and Time were aligned on Nov 3rd, 2025, because four times 45.2 degrees (45.215, unrounded) corresponds to a price increase of 180.86. Hereafter, a decline set in.

NVDA may not have run its course yet and may surge to a second peak by the end of February 2026, driven by strong earnings and prospects.

Perhaps, we may see a Head-and-Shoulders pattern emerging, which may cause a further decline to the lower 4x1 Saturn timing line. Note the gap around $120, which is often filled once the decline sets in.

AAPL - Apple Inc.

AAPL may have made a crest by February 6th, 2026, after a 49-degree move of Saturn since the high in January 2022, on a 2x1 Saturn timing line.

The number 49 is a critical angle at which inflection points are often observed, whether in days, weeks, months, or years.

There appears to be an 18-month cycle in AAPL, which could indicate a 4-year low and an 18th low around October 2026. A price target of $214 may align with a 45-degree move in Saturn from the October 2022 lows on a 2x1 timing line. Although the current fair value is much higher, it’s not out of the realm of possibility that this price level could be reached during a panic.

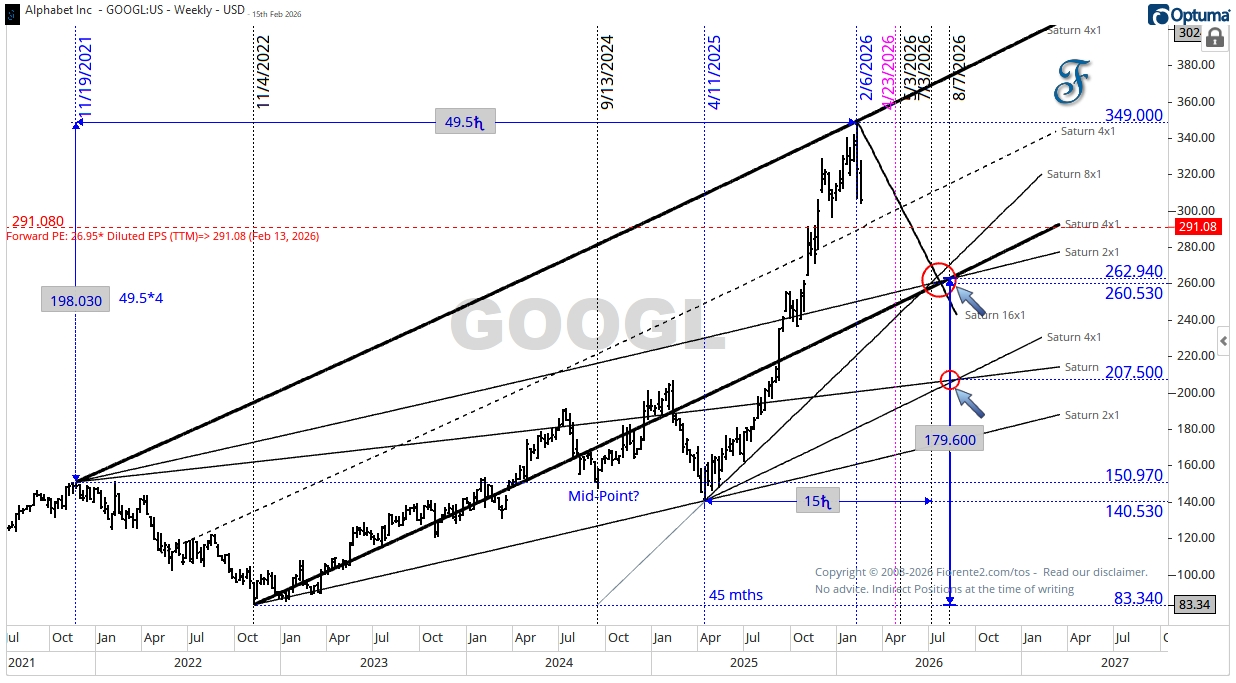

GOOGL - Alphabet Inc.

For GOOGL, a price and time square out occurred on February 6th, 2026, on a 4x1 Saturn timing line.

I am looking for a potential low around July-August 2026, which may be only a first decline towards the lower 4x1 Saturn timing line drawn from the October 2022 low. A rebound may occur, with a potential second trough in October 2026.

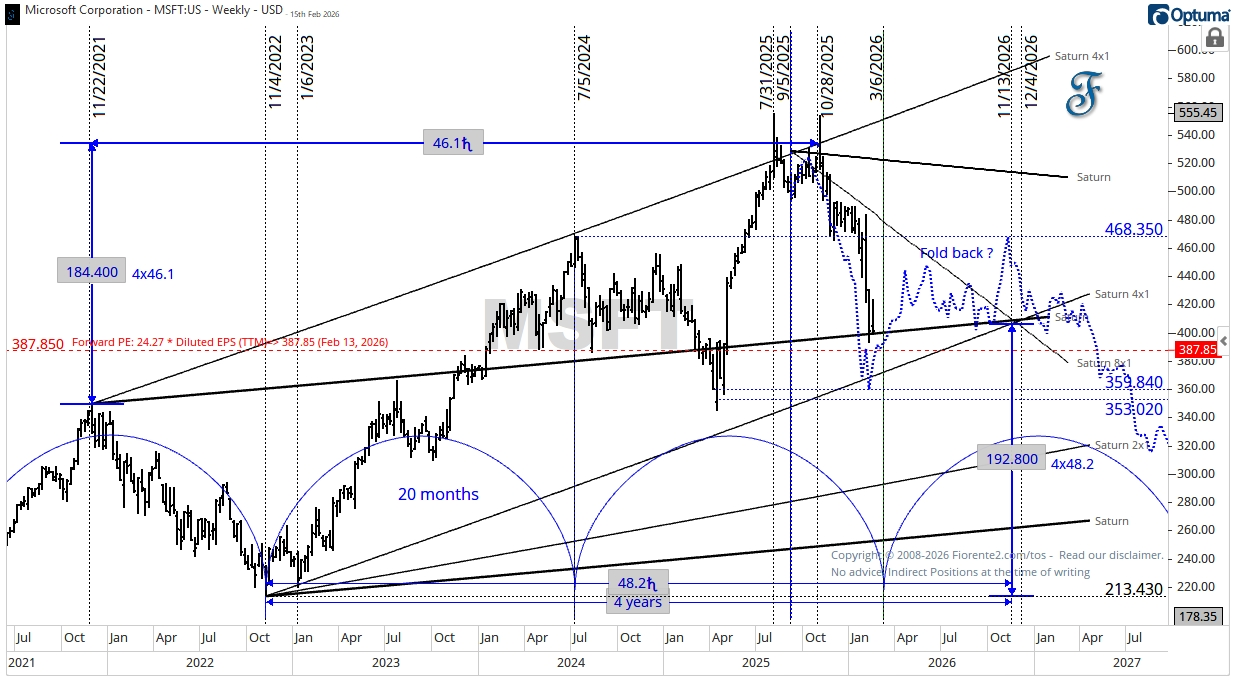

MSFT - Microsoft Corporation

Microsoft made a double top between the end of July and October 2025, on a 4x1 Saturn timing line. The Saturn 1x1 timing line from the November 2021 high seems to give support for now.

MSFT has fallen along the mirror-image foldback scenario and is approaching fair value based on the 12-month trailing earnings per share and the expected forward Price-to-Earnings ratio. If the foldback continues, this may indicate that a Head-and-Shoulders pattern is emerging.

Using calendar-day timing lines, the chart appears slightly different.

In the chart above, I used a calendar-day timing line based on a price of $0.1 per calendar day. A March low around $353 may align with the lower calendar-day timing line drawn from the lows in March 2020 and October 2022.

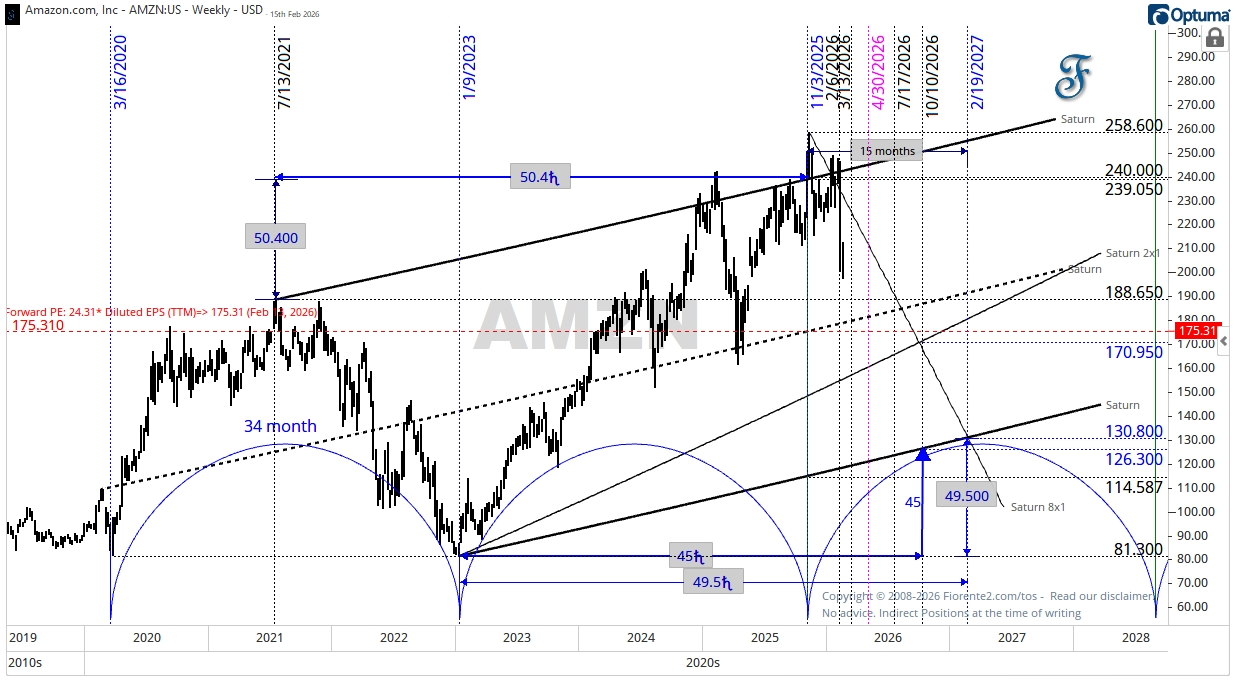

AMZN - Amazon.com, Inc.

Amazon may found its Price and Time alignment on November 3rd, 2025, and a second top on February 6th, 2026, right on a 1x1 Saturn timing line.

I expect Amazon to decline to at least the halfway point, or close to its fair value, in the $170- $175 range by October 2026. In a panic, I wouldn’t rule out Amazon dropping further into the lower 1x1 Saturn timing line, around $130, by February 2027.

Conclusion

In this post, I evaluated the DJ Transportation and DJ Industrial Averages across the Top 5 stocks by market capitalization. Both indices reached a high near the 60-year cycle peak, suggesting the market may be nearing a top.

It may still be too early to conclude that a top has been reached in this bull market. There is always some lost motion in any system, which may cause the NYSE “machinery” to continue moving for a while. Certain major cycles might be extended due to retrograde movements of various planets during the past cycle, and some cycles may still be ongoing.

Most top-5 stocks, however, have recently reached their highs, and some may be close to a short-term rebound, potentially fueling the stock market again. There is no overall clear direction yet.

For me, it is clear that October 2026 marks a point where multiple cycles- such as the 60-, 45-, 22-, 19,86-, 4-year, and 18-month cycles- align toward a probable cycle low. Various timing lines on the charts discussed may indicate at which price level this cycle low could occur.

This is my current bias across different indices and stocks. Remember, cycles can contract, extend, and invert. I may be wrong, of course. Anomalies can occur, fundamentals can shift, so be cautious. I expect some significant volatility ahead.

In case you haven’t noticed, every week I post various charts in the Substack notes. You can find them all here. (click on the link)

P.S.: Occasionally, I share new analyses exclusively for free subscribers. Subscribing gives you email updates on these posts, plus extra insights and deeper research from the time you join onward; past analyses are not included.

If you liked this post from @Fiorente2’s Blog, why not restack and share it?

© 2008–2026 Fiorente2.com. All Rights Reserved.

Disclaimer: This analysis is for informational and educational purposes only and should not be considered investment advice. Read our full disclaimer.

Disclosure: From time to time, I may hold positions in the securities mentioned.