Introduction

We have just updated our March 2022 analysis on Wheat. This post is for educational and learning purposes only as to show you how W.D. Gann looked at major and minor cycles in making his forecasts.

Back in March 2022 I wrote: …I expect we will see a probable high in Wheat from August 2022 towards January to February 2023 and give or take a couple of months this could be extended from April/May 2022 - August 2023.

Much has happened since our last analysis from March 2022 and the Wheat high came in a bit earlier than expected as the war in Ukraine gave a sudden surge in price. There seemed to be an inversion which gave a high a surge in price in May 2022 again. Recently in July/August 2022 Wheat seems to have found a bottom for now and currently in rebound.

I believe W.D. Gann’s 90 year cycle may have repeated in 2022 again, similar to 1932 and 1842 (also opposite to the Stock Market Indices in those years as like in this year).

As W.D. Gann mentioned in his Master Commodity Course:

“When we start from Sunrise or the Horizon and measure to Noon, we get an arc of 90 degrees, which is straight up and down staring from the bottom. 90 months or 90 years is a very important time period. The 90-year Time Cycle is one of the very important ones because it is two times 45. This time period must always be watched at the end of long time periods. For example: 1932 was 90 years from 1842. Study the wheat around this time. 1850 and 1851 add 90 years and we get 1940-41. Note low prices of around that time.”

However, there are other cycles in play and this was not the only cycle he followed on Wheat. He also mentioned: 82 to 84 years, 60 years, 45 years, 30 years, and 20 years. The Minor Time Cycles he mentioned are: 13 years, 10 years, 7 years, 5 years, 3 years 2 years and one year.

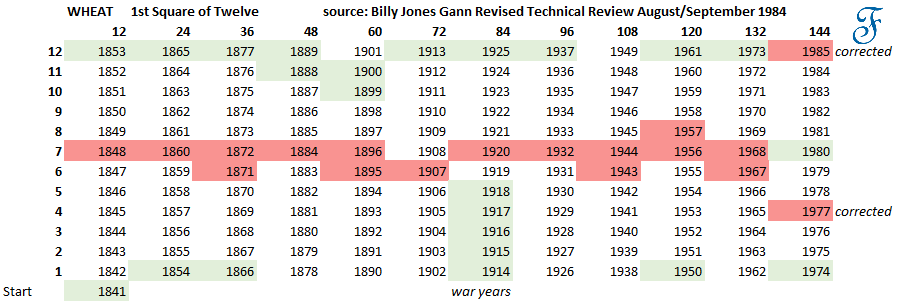

In below Master 12 chart you can see for a long time there was a dominant cycle that set tops and bottoms almost like clock work. It may be a 11/12 year cycle possible related to Jupiter.

In the above chart you can see that half way (6-7 year) there was usually a bottom(red) and on the top of this Master 12 chart it was usually associated with a top(green).

This Master 12 Chart that W.D. Gann taught gave a quick yearly overview on where you could expect future tops and bottoms. From 1980 I see the cycle inverted and the market became more complex. I had to correct the square of twelve that Billy Jones mentioned in his Technical Review of 1984 (e.g. bottom 1979 = actually bottom 1977). Not sure what the cause is, but the date (1980) seems to suggest that climate change may be a reason.

Clearly the weather around the world has changed in the last 40 years. There are may be other factors that can play a role, such as the increased use of fertilizers and the development of disease- resistant wheat varieties that causes for better yields.

Factors like geo-politics : such as currently the war in Ukraine and export bans, and the more extreme weather conditions have certainly played a role in the supply and demand of wheat and thus have influenced the price for Wheat to be paid. Currently the price has settled down In July/August 2022 somewhat from the recent March/May 2022 highs.

So, it can sometimes be a challenge to make a projection on Wheat on the very short term. So, be careful not to conclude cycles have turned to soon, but also look into the volumes of supply and demand and other constraints that may affect price. So, be careful out there, cycles can contract, extend and invert from time to time. So, no advice. Trading futures is a high risk business and should be left to experts in the field.

Our paid subscribers here on Substack can continue reading the updated analysis on Wheat. In this update post on Wheat we are looking at some minor cycles that W.D. Gann mentioned in his course and where possible changes in trends in the near term future can be expected. This will also give a feel about the direction of inflation.

P.S.: On all of our communications, posts and analysis our Terms of Use and Disclaimer apply. Hypothetical or simulated performance based on past cycles have many limitations. Hence, past performance is no guarantee for the future. Anomalies can occur.