Introduction

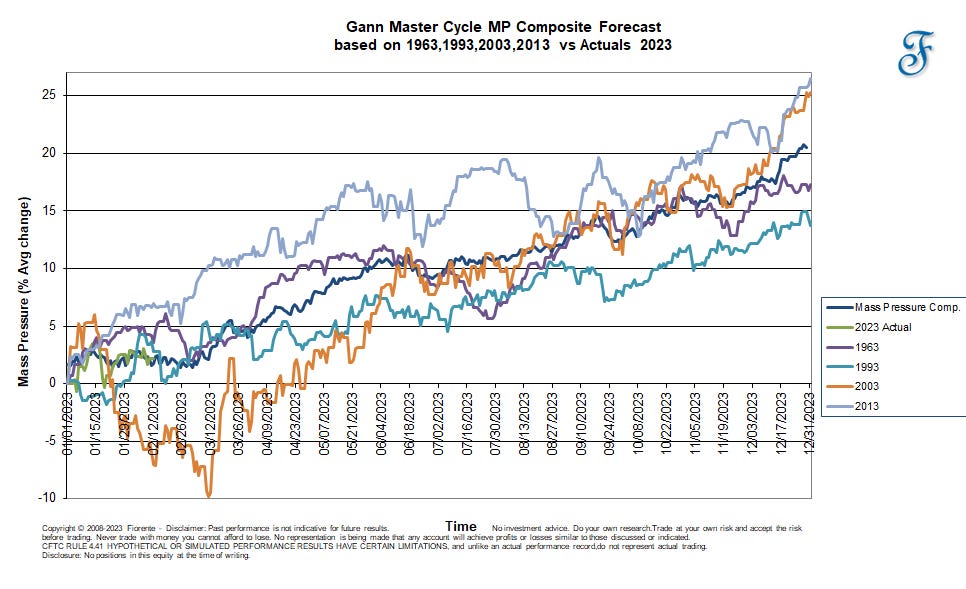

Recently, in early February, a subscriber asked me a question about using a composite of several Gann Master cycles:

“I wondered if the composite 10/20/30/60 Cycle has a similarly good coefficient? This composite is sometimes mentioned when reading about the Gann Mass Pressure Index, I think ?” T.B. UK. 0210/2023

The subscriber was asking about the correlation of other Gann master cycles with todays market. I sent him the following chart for his review.

I do not think the composite (blue cycle) in the above chart adds any value for this year. The most important of these cycles are the 60-year and 20-year cycles. So far, the DJIA and SPX followed the 60-year cycle, the closest to any other cycle. There is a reason why W.D. Gann called this cycle – The Great Cycle – The Master Time Factor. In his own words:

“This is the greatest and most important cycle of all, which repeats every 60 years or at the end of the third 20-year cycle. You will see the importance of this by referring to the war period from 1861 to 1869 and the panic following 1869; also 60 years later- 1921 to 1929 the greatest bull market in history and the greatest panic in history followed. This proves the accuracy and value of this great time period.” W.D. Gann Stock Market Course

This cycle can invert but not so often. It is 3x the Jupiter Saturn cycle of nearly 20 years, on average 19.9 years. The Master Time Factor, or the Gann Master cycle, as I call it, is not exactly 60 years; it takes around 59.6 years for the Earth-Jupiter-Saturn to align around the Sun again. So, looking back on what happened, approx. 20 and 60 years ago may not be a bad idea as these major planets may start a new cycle.

Every 60 years, themes in society seem to repeat. Compare the Russia-Cuba missile crisis of 1962 with today’s Russia-Ukraine turmoil and a looming China-Taiwan threat. But there are other master cycles to consider, of which themes seem to repeat, like the 49/50-year cycle. There was an oil crisis in 1973, inflation & rate hike fears in 1974, and the early 1920s, 100 years from now, there was a concern about the oil supply.

Evidence of the Gann Master Cycle’s existence has also been found in climate research. You will find some interesting research here on the 60-year cycle.

I have reviewed some of these master cycles that may repeat in 2023 in the Fiorente2 Stock Market Outlook 2023 for a full year ahead. You can still grab a copy at a reduced price (click the above link). Each week I follow up on the Gann Master cycle in my weekly weekend post here on Substack with a forecast for the next two to three weeks.

In 2018, Dave S. Gilreath, partner and founder of Sheaff Brock Investment Advisors, wrote on CNBC, “Here’s why the Dow will hit 40,000 by 2025”. I think he may be right, and the DJIA may even go higher based on the 60-year cycle and timing lines from the low in 1980, the start of this great Bull-market we are still in.

I have updated the above chart for our premium subscribers alongside longer-term views on some of the more relevant Gann Master Cycles in the below post.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.