Introduction

Gold has been the talk of the Twitter community in the past few weeks. You can find many forecasts to predict a bright future in Gold investments. I am not so sure for now. There is an 8-year cycle that still has some time left to unfold further. I may be wrong. But then, I see a pattern of a third peak arising that does not make me feel comfortable. As. W.D. Gann mentioned in his Stock Market Course:

“This formation occurs when a stock or the averages make 3 tops near the same level or the 2nd, and 3rd tops are slightly lower. When these formations are made at tops after a long advance, they are signals for a major decline. The more time between tops, the stronger the indications for a big decline.” W.D. Gann Stock Market Course

This guiding rule also applies to commodities.

Of course, he also mentioned in his Commodity Course:

“Triple bottoms are the strongest and triple tops the strongest, but it is very important to watch an option when it reaches the same level the fourth time as it nearly always goes thru.” W.D. Gann Commodity Course

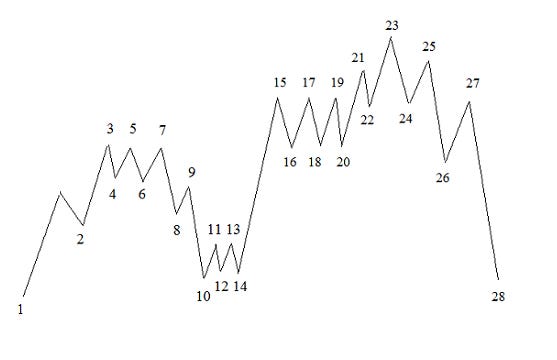

If the latter happens, that may create a “Three Peaks and a Domed House” pattern in the longer term.

We are not at that point yet. However, this pattern may fit my thesis that we first have to set an 8-year cycle low in Gold.

In this post, I will look at the price-time symmetry of Gold. When price and time align, a change in trend may be imminent.