The Power of Using Gann Cycles in Timing the Market

#170 An update on the US Indices: DJIA, S&P500, Nasdaq

Introduction

When financial markets experience significant trends, it can be both monotonous and confusing. Often, the markets move in a parabolic motion, making it challenging to forecast when stocks and indices will change in trend.

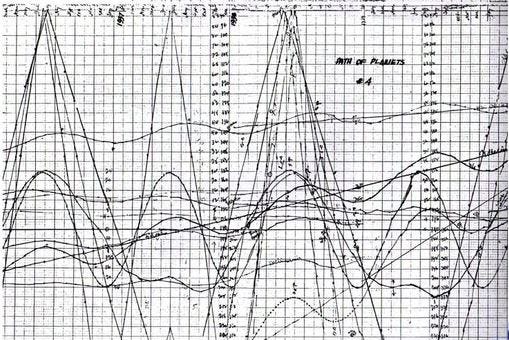

In his Stock Market Course, W.D. Gann discussed many times how you can utilize cycles from important tops and bottoms to see where the stocks and indices are heading.

He discussed several cycles that are important to consider while making an annual forecast of a stock or index. These cycles include the 60-year cycle, 30-year cycle, 20-year cycle, 15-year cycle, 10-year cycle, and 7-year cycle. Among these, the 20-year cycle is the one that most stocks and averages work closer to than any other. Gann named the 15-year cycle as important because it is 180 months or one-half of a circle (of 360 degrees). The 10-year cycle produces extreme highs or lows every 10 years, and stocks come out remarkably close on each even 10-year cycle, making it a crucial cycle to consider. The 7-year cycle is also important, and you should watch seven years from any significant top and bottom. From: W.D. Gann Stock Market Course

Currently, the stock market seems to be following many of these well-known Gann cycles. I have prepared a couple of charts for the premium subscribers to discuss the possible price and time targets based on these cycles in this week’s update on the US Indices.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.

Disclosure: No positions at the time of writing.