The Meme Saga Continues

#233 An update on Bitcoin and the US Indices: Nasdaq, S&P500 and DJIA.

In Last week’s Post I mentioned: “Throughout history, societies have experienced cycles of rise and fall. Influential leaders often demonstrated their power and boosted their egos by building towers; the taller the tower or the greater the number of towers, the mightier the city or country was perceived to be. When these displays of strength were insufficient, the powerful frequently resorted to greed, seeking to expand their control by invading other territories. This pattern continues in today's world. One could easily substitute the word "towers" with "rockets." or now include meme coins as President Trump launched his om meme-coin ($Trump) 2 days ahead of his inauguration.

From a historical perspective, it is obvious that Donald Trump created his own coin. Emperors in the past did this for economic gain or control, political propaganda, or even military funding. The meme saga continues, and many are rushing into a new meme coin which real store of value and purpose is unclear.

At the end of a cycle, you will typically see everyone rush with greed to get a piece of the pie. The Trump Memocoin is not different from Bitcoin, investing in Tulip Bulbs in 1637 or any other meme phenomenon. In my opinion, this new meme coin is another example of extreme speculation rather than serving as a serious investment in a valuable asset.

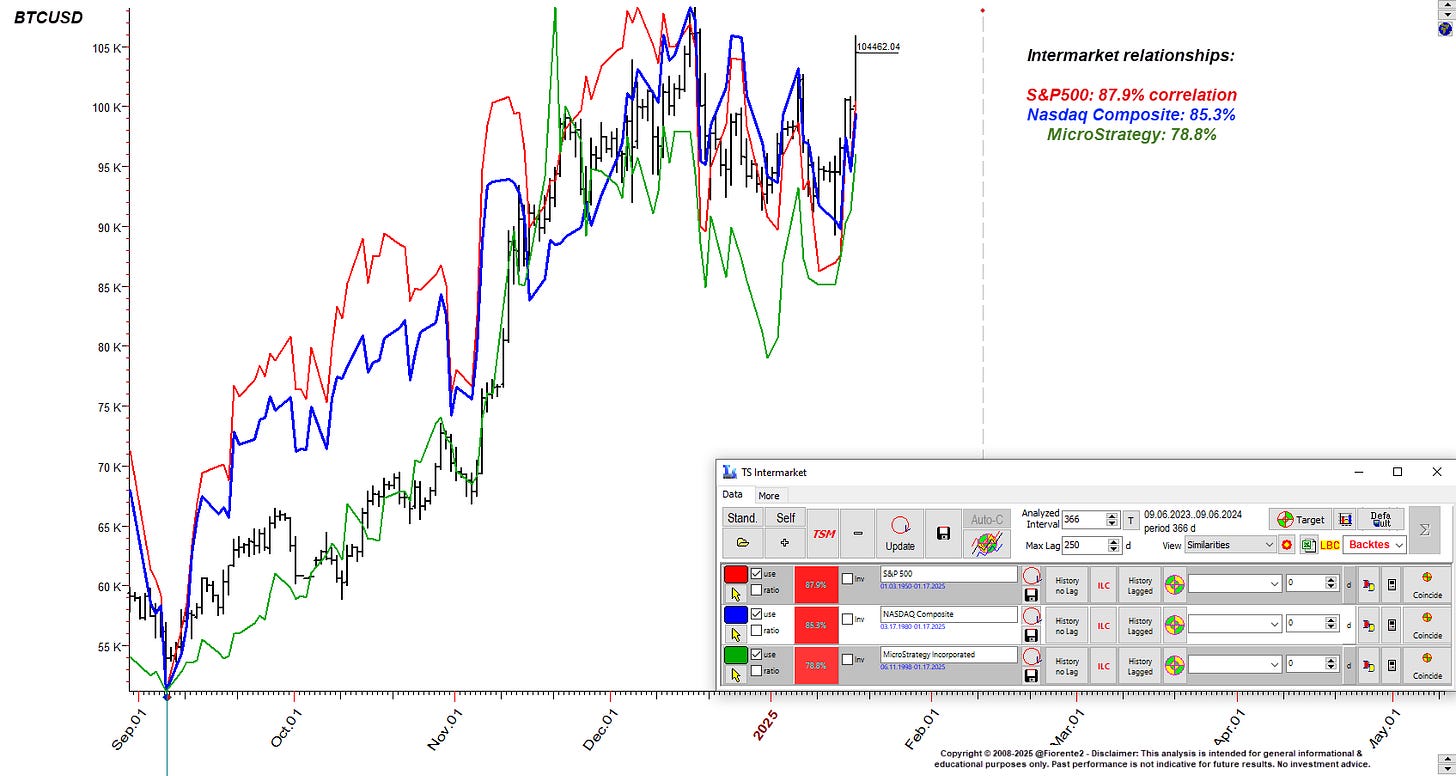

Since mid-December, the BTC/USD trading has fluctuated between 108,000 and 89,000, driven by alternating feelings of greed and fear.

Comparing it with the US Indices the correlation between the S&P 500 and the Nasdaq has been very strong since last September. If this correlation with the US indices persists—although that is not guaranteed—and considering the 60-year cycle I observe unfolding in the US indices, there may still be potential for both Bitcoin and the US indices to continue their recent rebound until early February, or even longer. Note: There is a lesser correlation (still 75%) with MicroStrategy which invested heavily in Bitcoin.

Nobody exactly knows how President Trump's new US economic policies will play out or what impact they will have on the financial markets. So, I foresee a volatile year ahead that may be similar to last month’s period.

In this weekly update, I will review additional charts on BTCUSD and update last week’s post on the US Indices: DJIA, S&P500, Nasdaq Composite, and Nasdaq 100.