Introduction

Last week, I published the long-term view of the DJIA squaring out in Price and Time from the September 1900 bear market low.

In Gann terminology, "squaring price and time" refers to a balanced or harmonious relationship between the price and time dimensions, often indicating significant market reversals. Price and Time are interchangeable.

I showed the premium subscribers last week that the S&P 500 and the NYSE Composite Index are also close to import square outs in Price and Time. You can review that post here. (click on the link)

George Lindsay, a legendary trader and analyst, published a treatise in the 1950s, “An Aid to Timing”, in which he showed that the long-term cycle consists of at least 2-4 sub-cycles. He used simple calendar day measurements between highs and lows that are of equal distance from a midpoint (a pause in the market), to show where the trend may change.

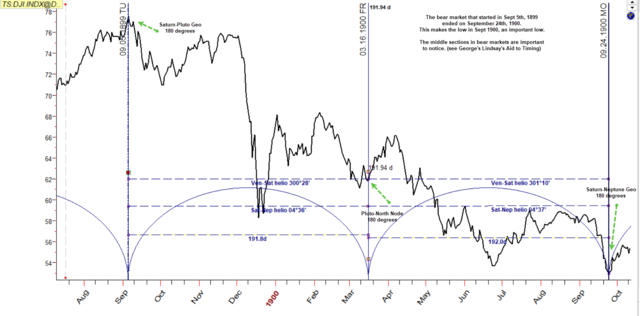

The 1899-1900 bear market serves as a good example, as seen below. I believe he used his astronomical knowledge to pinpoint the right moments, as illustrated in the chart below.

The midpoint (March 16, 1900) is not only equally distant from the September 5th, 1899 high, but also from the September 24, 1900 low in calendar days. Additionally, it aligns with astronomical cycles, such as Venus-Saturn, Saturn-Neptune, and inflection points occurring on Saturn-Pluto and Saturn-Neptune oppositions (180 degrees apart).

The midpoint and the equal distance between the high and low revealed the end of the bear market. Hereafter a 29-year bull market started. From this important low in September 1900, we have reached the recent high of around $45,631 in 45,631 days. This seems to form quite some resistance.

I do not think the September 1900 low was a midpoint in itself, on a very long cycle; however, the same midpoint technique George Lindsay showed in his work and newsletter can be used to find where the start and end of a future bull/bear market may be located.

In this edition, I will show premium subscribers where the current bull market might likely end, using George Lindsay's mid-point cycle technique on the DJIA. This could provide you with a perspective on longer-term cycles and why the DJIA may not have reached its peak in the current bull market.