US Markets in Retreat- the US tariff war return?

#262 An update on the trends in the US Indices

Introduction

Last week, I mentioned: “Will the bull rebound continue, or will concerns about inflation (bear) and the trade war reignite investors' anxiety?” The latter seems more likely. It seems President Trump is adhering to the 60-year cycle, as he stated on Friday: “The E.U. will face a 50% levy starting June 1 because trade talks are 'going nowhere.”

On Friday, the US President also approved Nippon’s investment in US Steel, which he claimed is the largest in the Commonwealth of Pennsylvania’s history. He stated that tariff policies will ensure that steel will once again be, forever, made in America.

US Steel made a 21% jump on Friday's announcement in the last hours of trading.

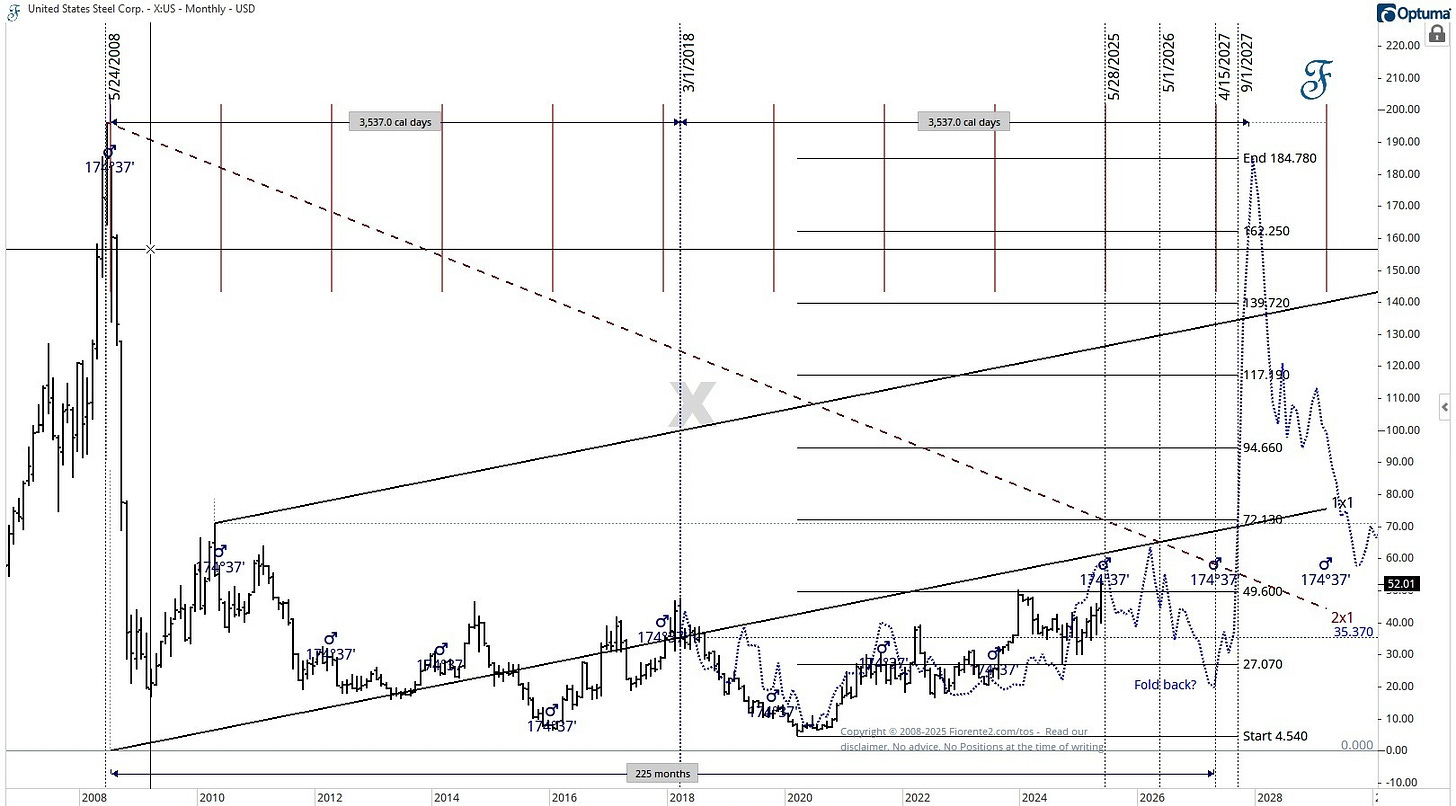

The jump in US Steel (X) on Friday was unsurprising, considering Mars’s upcoming return at a 174-degree angle since the high in May 2008. The recent move will probably not last long, as planetary aspects of Mars do not last very long. Moreover, the stock is still trading below the 2x1 Gann timing line (dashed maroon line) from the 2008 high and below the 1x1 Gann timing line (solid black line) from the zero point of the 2008 high (black).

The stock may jump on a 90-year cycle later in 1927, but the foldback may continue to slumber until then, before US Steel trades back within the larger trading range (if at all).

The US President seems to be nostalgic, possibly envisioning a renewed US industrial economy reminiscent of over 90 to 120 years ago, when US Steel was the world's largest company and could significantly influence the DJIA. However, that is no longer true.

Today, we inhabit a new economy, primarily shaped by a boom in technology, particularly artificial intelligence. US levies issued on, e.g., technology products from US Companies or partners made abroad may not be very helpful for today’s world economy.

The significant US tariff levy discussion will resurface in the coming month, coinciding perfectly with the 60th anniversary of the US imposing tariffs on its European counterparts. The 99-year cycle analogy, which resonated on the DJIA in the first four months of the year, may now have been broken.