Lack of Investors Confidence - Oct 20, 2023

A Gann Master Cycle forecast following the DJIA, SPX, Nasdaq Composite & Nasdaq 100, US Treasury Note, Gold, Crude Oil - #152

Introduction

As mentioned in last week’s article: “When the turmoil around the world escalates further, the stock market may not be at the end of a downturn yet,” which reminded me of the 49/50 year Gann Master Cycle.” and so did the downtrend continue right after the Solar Eclipse of mid-October. Will the downturn continue?

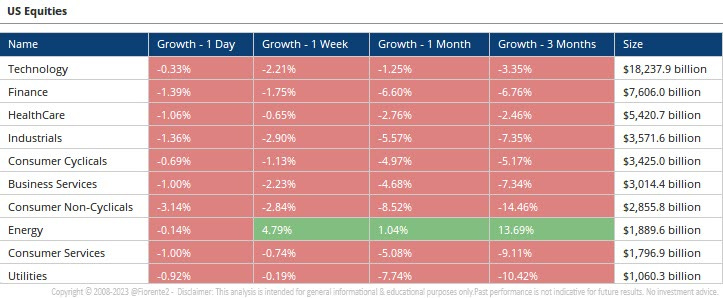

Looking at the main sectors in the US Stock Market, it may take a while before investor confidence will return.

Investors' lack of willingness to take on risks suggests a lack of confidence in the economy, reflected in their reluctance to invest in the JNK-ETF.

The top-10 stocks have just unfolded a foldback, and if history repeats in a mirror-image fashion, it does not bode well for the next few months.

It is possible that between the recent Solar eclipse and the upcoming Lunar eclipse on October 28, 2023, the market may rebound for a while, as shown in the foldback scenario observed last week.

If the 8-year cycle of the Gold Futures continues its path, this is a possible scenario to keep in mind. Additionally, Crude Oil may experience a temporary rebound from its recent upturn. The US 2-year Treasury Note is unfolding a nearly 30-year cycle, and Wheat also seems to continue on its downturn as forecasted a year ago in the annual publication on the Stock Market Outlook 2023.

So, in this weekly edition of the Fiorente2’s Newsletter, I will review Gann Master Cycles for the major US Indices, as well as give a quick update on what is happening in Gold, Crude Oil, Wheat, and the US 2-year Treasury Note. This is a longer-than-usual post, so the email to the premium subscribers may be truncated. However, they can continue to read the full story in the Substack app or on the substack website.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.