Introduction

Patterns do matter, as W.D. Gann already noted more than 100 years ago. He called looking at patterns “Form reading”:

“Eight-five percent of what any of us learn is from what we see. It has been well said. ‘One picture is worth a thousand words.’ That is why FORM READING or the reading of various formations at different periods of time is so valuable. The future is but a repetition of the past. The same formation at tops or bottoms or intermediate points at different times indicates the trend of the market. Therefore, when you see the same picture or formation in the market the second and third time, you know what it means and can determine the trend.” W.D. Gann Stock Market Course

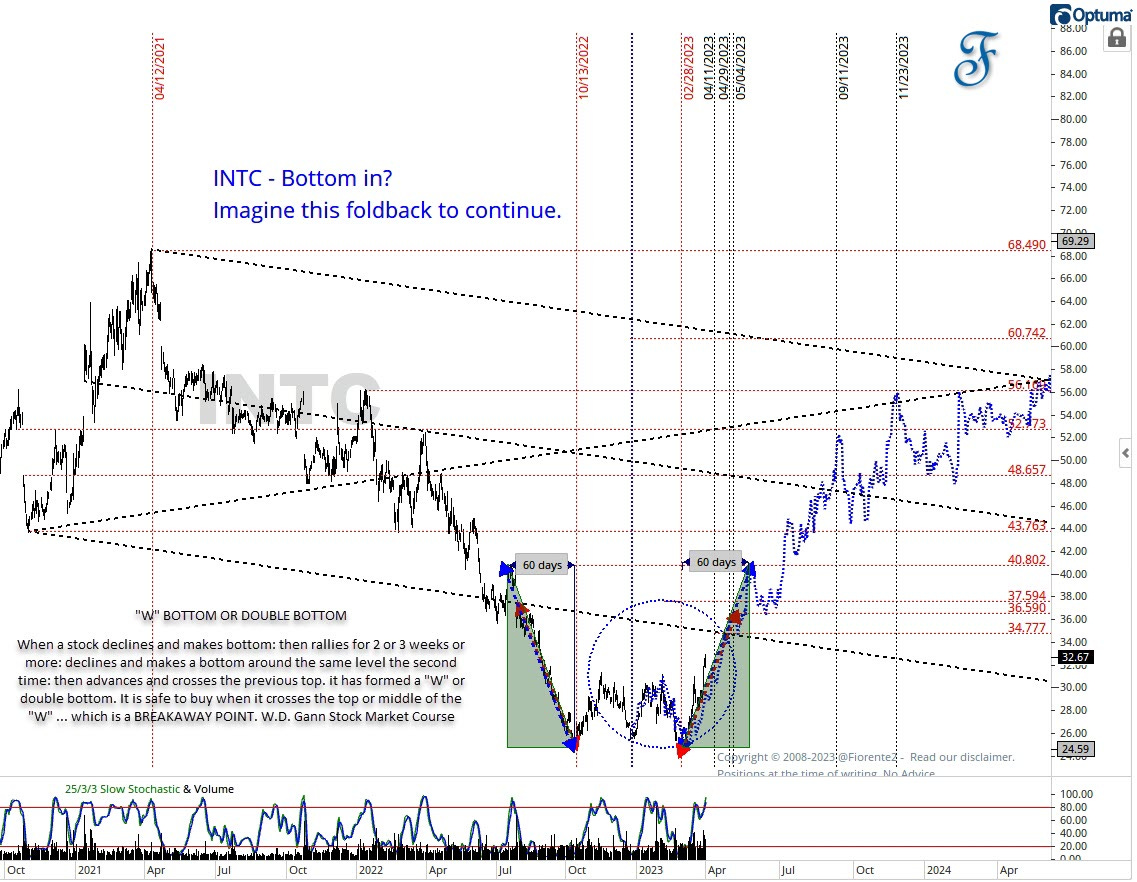

Recently INTC made a nearly 2-year downslide from April 2021 to March 2023 and made a double bottom in the form of a “W” pattern.

Most of the time these planetary motions cause these patterns revisiting the same angle again.

W.D. Gann explained the “W” bottom or double bottom in his Stock Market Course:

When a stock declines and makes bottom: then rallies for 2 or 3 weeks or more: declines and makes a bottom around the same level the second time: then advances and crosses the previous top. it has formed a "W" or double bottom. It is safe to buy when it crosses the top or middle of the "W" which is a BREAKAWAY POINT. “W.D. Gann Stock Market Course

At some point, the mirror image foldback at some point in time will cease to function. Technically, this may be a candidate for a quick run and perhaps a continuation along the blue mirror image foldback line.

After a 2-year downslide you, may expect a recovery for a year. Bear markets can continue for 5-7 years (as seen last 7 years in IBM). Fundamentally, there may be better companies to invest in.

In the below post I will, explain to the premium subscribers in more detail the foldback, the probable cause and possible future target and alternative if the foldback continues. I also will look discuss the analysts' expectations for this and next year.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.