Introduction

Today, I researched the top US banks on my watchlist: JPMorgan Chase, Bank of America, and Wells Fargo. These banking institutions have a long and impactful history in the American financial sector and are significant global players.

JPMorgan Chase, with assets worth $3.40 trillion, is the largest and most influential of the three, followed closely by Bank of America, with assets worth $2.54 trillion, and Wells Fargo, with assets worth $1.73 trillion. Each bank has a unique background, offers a range of digital banking tools, and serves millions of customers worldwide.

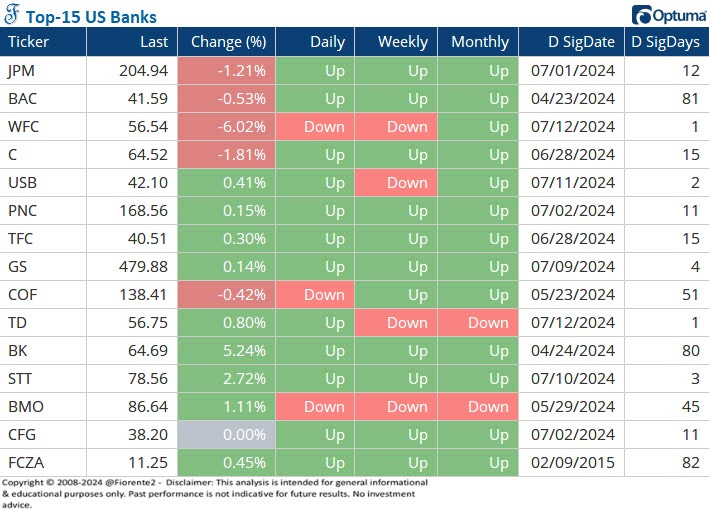

As of December 31, 2023, the top 15 banks on my list collectively had around $12.95 trillion in assets.

Most banks are currently trading above my daily, weekly, and monthly reversal levels. However, the top three banks traded lower last Friday, with WFC dropping as much as 6.02%. WFC has been trading lower since mid-May this year and is already below its daily and weekly reversal levels. Will the other banks follow this trend?

Let's analyze the trends of the top three US banks from a Gann perspective using a specialized technique that most people are not familiar with, to identify potential support and resistance levels.