Whilst the US Indices made a new high in 2023, the Hong Kong Hang Seng Index (HSI) is trading lower, possibly following a 15-year cycle to lower lows.

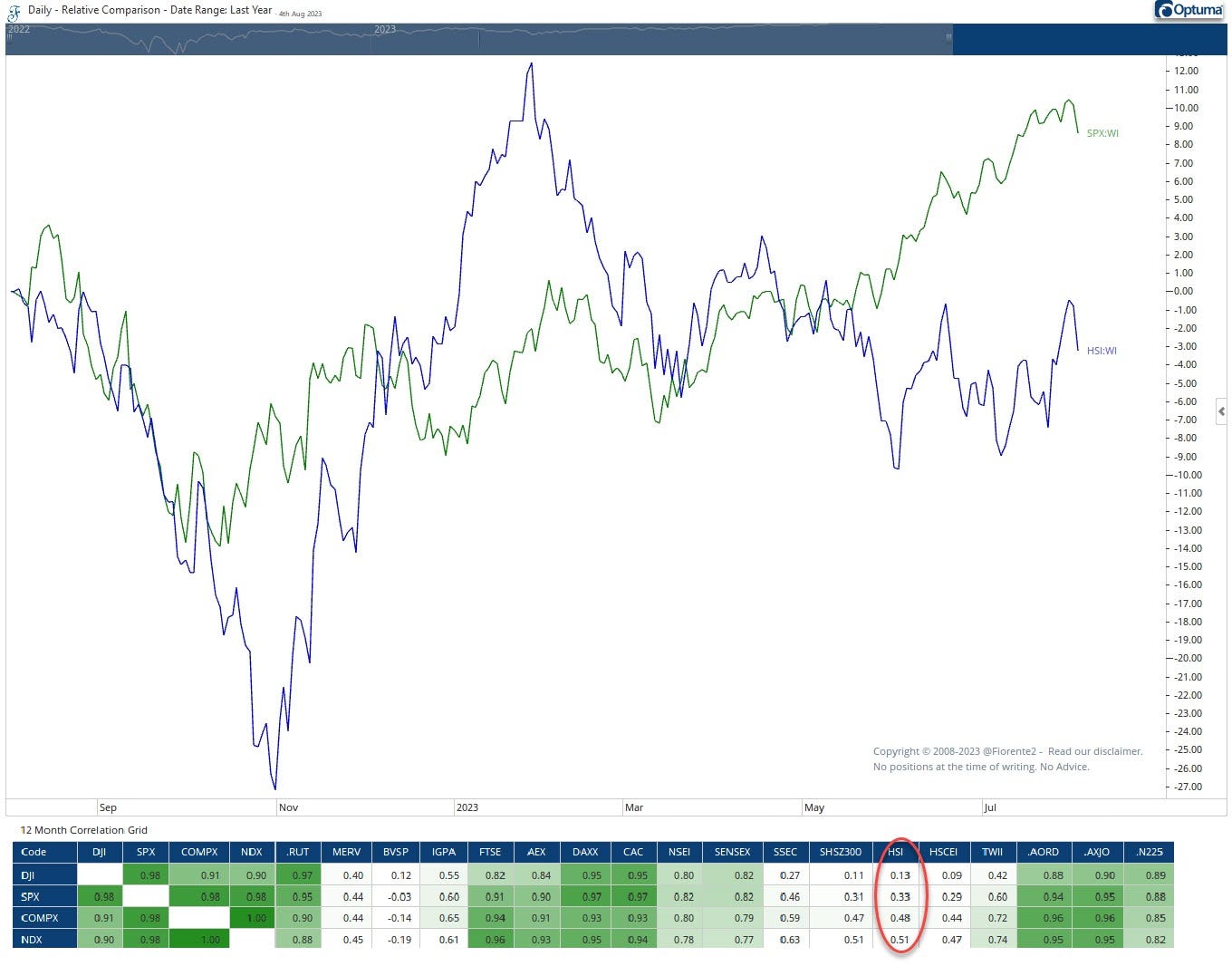

The correlation between the US Indices and the Hang Seng Index is not very strong. The relative comparison and correlation with the SPX and other US Indices may bring a thesis that the Hang Seng Index may react to the contrary when the US Indices turn to the downside.

Although the chart above at times may suggest otherwise, this year, the Hang Seng Index moved in the opposite direction of the US Markets. If investors withdraw their funds from the US Markets, they may invest in other regions, such as Hong Kong. After all, the money has to go somewhere.

Therefore, it would be wise to examine the current state of the Hang Seng Index. The article for today discusses the 15-year cycle, other time cycles, and a Gann Mass Pressure forecast, which may provide insight into the future direction of this index. I hope you find it informative and enjoyable to read.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.