Gann Master Cycle update - June 30th 2023

Exploring the Power of Squaring, Timing Lines, and Cycles in Analyzing Market Trends - DJIA, SPX & COMPX

Introduction

W.D. Gann was a master mathematician. In his stock market course, he wrote a lot about numbers and angles that represent specific numbers of support and resistance.

“There are two kinds of numbers, odd and even. We add numbers together, which is increasing. We multiply, which is a shorter way to increase. We subtract, which decreases, and we divide, which also decreases. With the use of higher mathematics, we find a quicker and easier way to divide, subtract, add, and multiply, yet very simple when you understand it.” W.D. Gann Stock Market Course

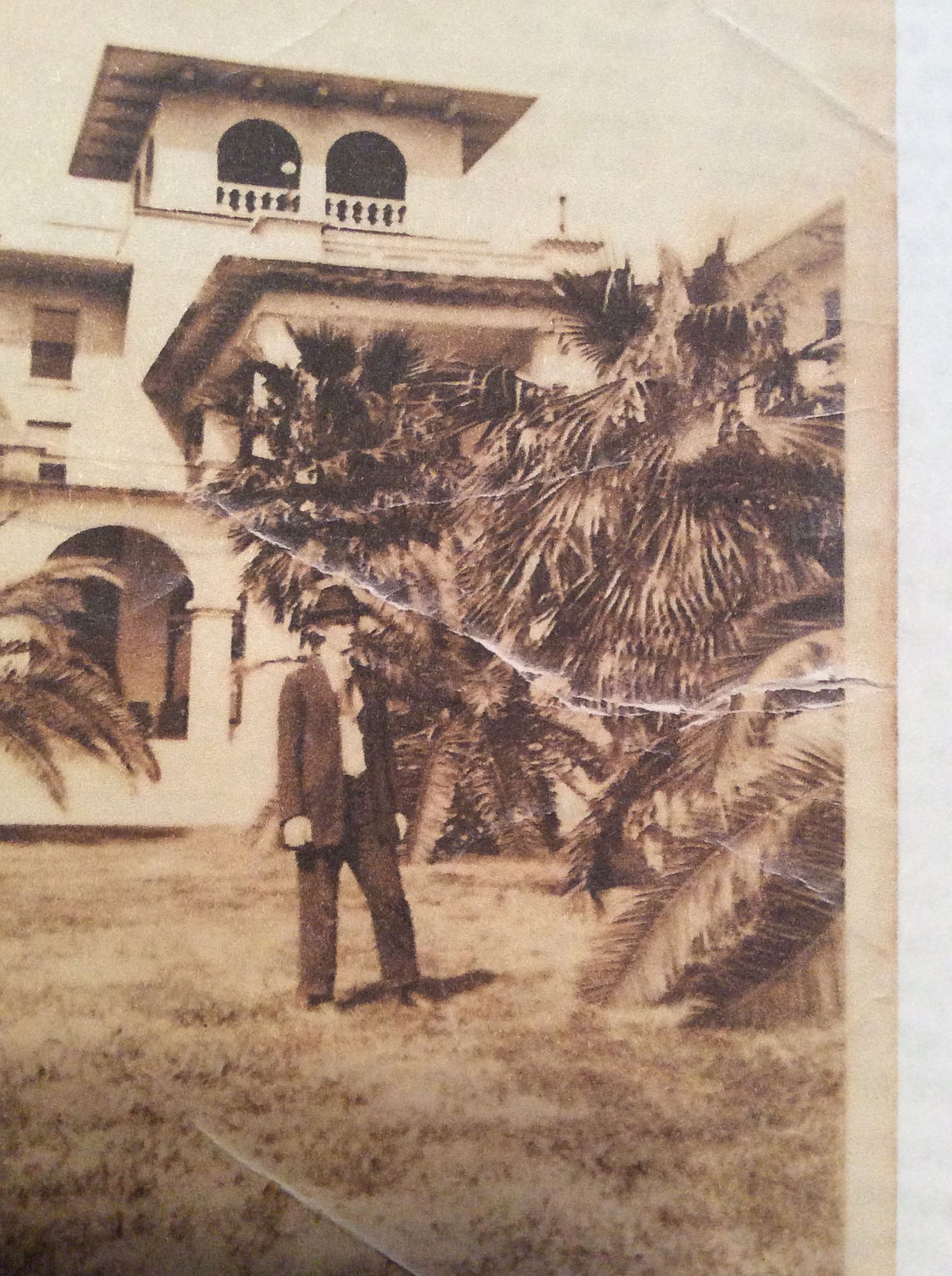

Referring to the use of higher mathematics, he probably referred to Vedic Mathematics. It is well known that W.D. Gann visited India to learn how they traded commodities in Calcutta. Here he learned about what later was known as the Gann wheel, which tea merchants in Calcutta had already used since the 17th century, and about the Vedic way of calculation.

Last Friday, I tweeted a Twitter thread (click on the link) with examples of how easily one can square numbers by the head, knowing the simple rules of squaring.

In the same Stock Market course, W.D. Gann wrote:

“There are three kinds of angles - the vertical, the horizontal, and the diagonal, which we use for measuring time and price movements. We use the square of odd and even numbers to get not only the proof of market movements, but the cause.”

I highlighted the last sentence in bold and italics as this is the quintessence of his work to find where price and time may be in balance and where possible changes trends may occur and from where the cycle did start.

A simple form of squaring price and time is the Pythagorean theory (a^2+b^2=c^2) we probably all have learned in secondary school.

In this week’s update, I will show you a few techniques on the DJIA, SPX, and COMPX, how to square in price and time, and find probable dates for a future change in trend. Where multiple cycles come together, there is a higher probability a change in trend may occur.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.