Introduction

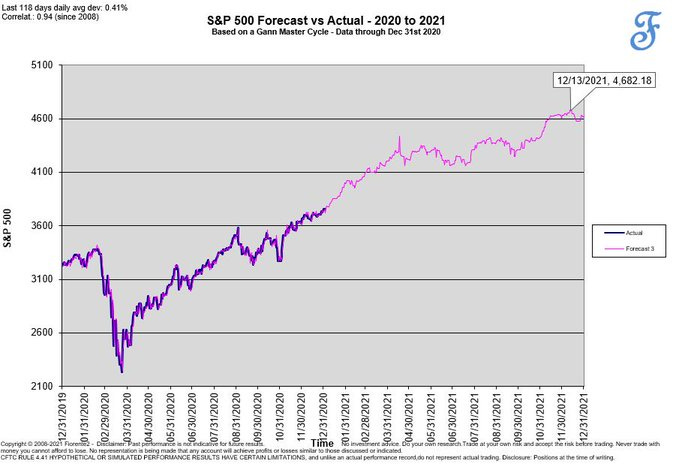

In this week’s post a weekly update on the Gann Master Cycle (GMC) as applied to the $DJIA and $S&P 500. The GMC projection we publish is dynamically updated as the market progresses.

Remember what W.D. Gann said: “Time is more important than price”, and “When time is up price will reverse”. Although our $DJIA and the $S&P 500 projections are dynamically forecasted based on past cyclical behavior, the price forecasted is not as important as the time. The current amplitude will from time to time differ from the past. Pivotal changes in trend after so many decades can be off for some time. Not only because there are some leap years in between, but also due to the retrograde movements of the planets. This may perhaps cause the cycle to contract, extend or invert. The Gann Master Cycle can invert but not that often.

It is a seasonal indicator. As in real live seasons like the weather can change from one year to the other this can be noticed in the stock market cycles as well. The Gann Master Cycle is however a cycle that seem to repeat similar cycle after cycle perhaps due to the planets - from which our days of the week are named after- returning to the same sign in the zodiac. You can clearly see this from themes from the past cycle that are currently repeating in society. The threats in Taiwan and Ukraine are quite similar to the Cuba Crisis in 1962.

Our projections in for the $DJIA and the $S&P 500 have been exceptional accurate. On December 13th, nearly a year after our forecasts from Dec 31st 2020, the $S&P 500 intraday with a high on 4702, hit our forecast of 4682 and closed on 4668.

In below update (for paid subscribers only) you can see how the Gann Master Cycle has been performing since the beginning of 2022 and the projection into the end of February 2022.

To see the full year ahead on the Gann Master Cycle please note we have published our forecast in the Stock Market Outlook 2022 with additional comments on the probable support and resistance levels. Next week I will publish a monthly add-on update for the Stock Market Outlook 2022 (for an additional minimal fee) with brand new charts and insights. Stay tuned.