Gann Master Cycle - Sept 22 2022

$DJIA, $SPX and $COMPX continue to follow the Gann Master Cycle (with charts updated to Sep 23rd 2022)

Introduction

Last week I wrote about the Mars Uranus panic cycle. We are approaching an angle between Mars Uranus around which time often a decline has been observed in the past. It was not so strange to see that the war in the Ukraine was intensified and nuclear threats are on the headlines again. It was like 1962 revisited, the “Cuban” missile crisis.

Whether this conflict will be resolved in the same timeframe as 60 years ago is to be seen. Although similar events occur, times are different. The Gann Master Cycle so far continues to follow an almost similar path compared to 60 years ago.

This week I tweeted a quote from W.D. Gann regarding the seasonal date of September 23rd from his Stock Market Course.

"September 23rd is 93 days from June 22nd, but the Earth or Sun has only travel 90°.The Sun crosses the equator at this time and is 180° or opposite the point where it crosses the equator on March 21st. Fall begins at this date, stocks make important changes in trend" W.D. Gann Stock Market Course

It is to be seen if the market will (temporary) change in trend or will continue on its path. I would not be surprised if we see some kind of W bottom forming over the next few weeks (like a year ago). We are close to 90 bars from previous pivots and this seems to repeat regular between high and lows in the US Indices and there are multiple links going into early to mid October to make such a W pattern possible.

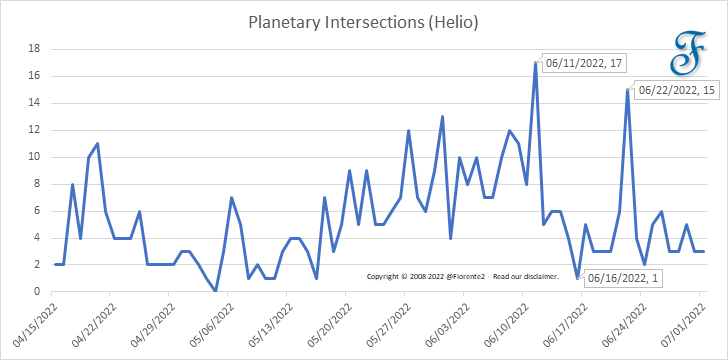

On the lows of June 16th we have seen some remarkable increase in spikes in planetary Intersections from a Helio perspective as you can see in below chart. The market fell right into it.

Something similar in October 2022 is on our radar as well and we have shared the information with our premium subscribers. This is also in alignment with the Mars Uranus panic cycle and not far off from the expected Gann Master Cycle low date.

The paid subscribers can read further from here on the above analysis in more detail and where we expect possible support in the next few weeks. In this post you also find the latest Gann Master Cycle dynamic updates for the DJIA, the S&P 500 and the Nasdaq Composite. We have also updated the list of stocks from the S&P100 that may have a cyclical turn in the next few weeks.

Hypothetical or simulated performance based on past cycles have many limitations. Cycles can contract, extend and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Read our disclaimer.