$DJIA/$S&P 500 Gann Master Cycle Update

$DJIA - an interesting Mars angle return and Spiral Calendar relationship

Introduction

The $DJIA and the $SP500 found support at the levels indicated on last weeks free charts for now. Both indices were ahead in price compared to the Gann Master Time Cycle. The rebound so far stayed below the 200 day Volume Weighted Moving average and the 10 month moving average.

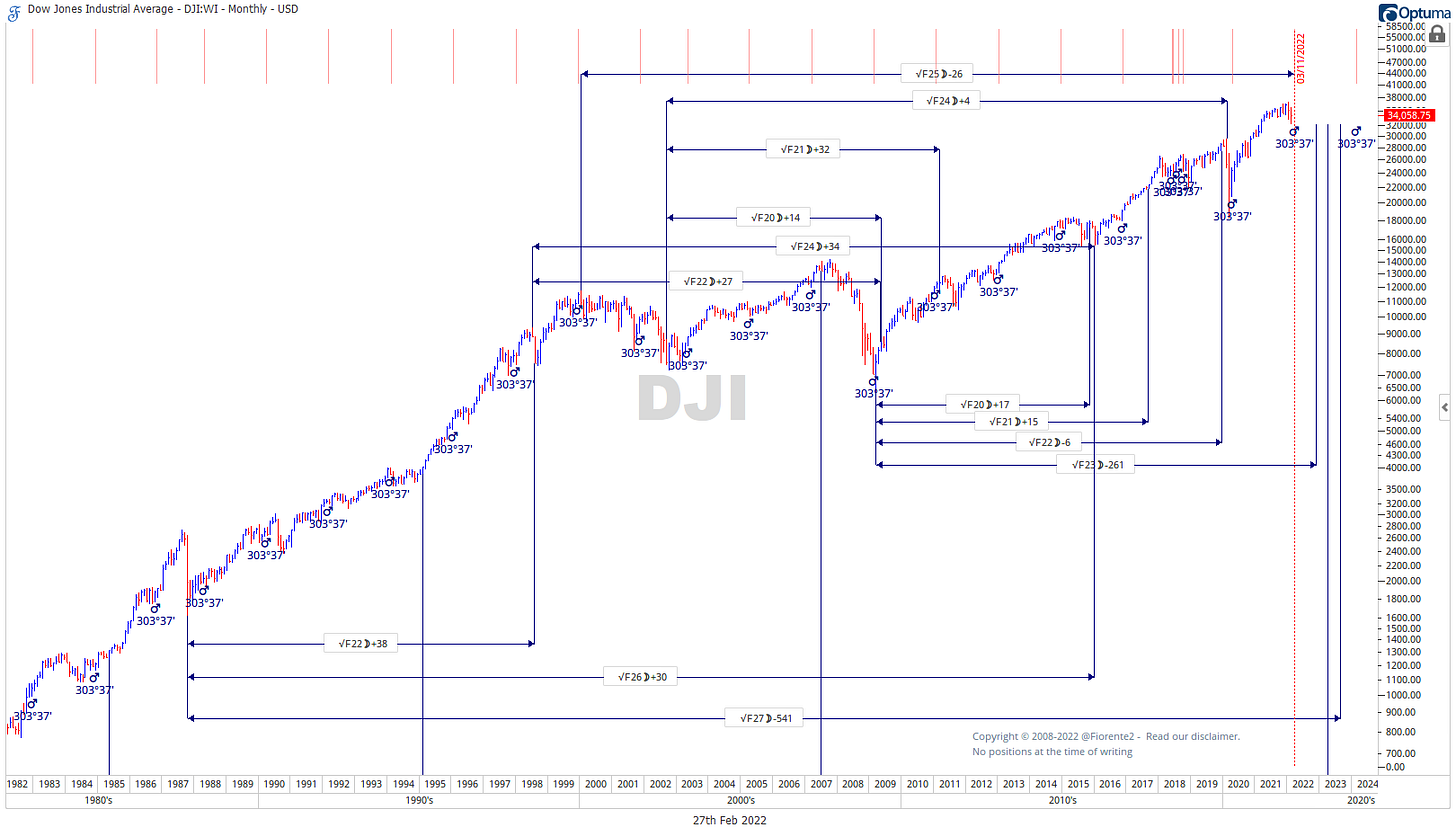

On the $DJIA I found another interesting time relation using the spiral calendar of Chris Carolan which in a few days is joining the angle return of Mars at 303° degrees. This is similar to the the high in January 2000. The angle return and spiral relationships between highs and lows are often associated with a continuation or change in trend as you can see in below chart.

The spiral calendar is based on the number of moons that equal the square root of a Fibonacci number, in this case the square root of the 25th Fibonacci sequence, since the high in 2000 will culminate on March 7th 2022.

We will continue to follow the indices and coming week we are working on an update to the Stock Market Outlook 2022 - third edition with brand new analysis. Owners of the Stock Market Outlook 2022 can buy this edition for a minimal fee here on Gumroad.

For now the Gann Master time factors of the 20, 60 and 80 year cycle have the highest correlation (80%) to this year. The 60 and 80 year cycle are both related to a theme of countries invading/threatening other countries, like the Japanese invading Singapore in February 1942, and The Russian-Cuba crisis in 1962.

Our paid subscribers here on Substack can continue reading this weeks update on the Gann Master Cycle following the S&P500 and the $DJIA. More analysis on various commodities and updates on various stocks will follow shortly.

P.S.: On all of our communications, posts and analysis our Terms of Use and Disclaimer apply. Hypothetical or simulated performance based on past cycles have many limitations. Hence, past performance is no guarantee for the future. Anomalies can occur and cycles can contract, extend or invert. So, be careful and always watch the charts in front of you.