Introduction

In his latest article, Tom McClellan wrote about: “how there has been a change in what Bitcoin is and how it behaves. Bitcoin prices are now walking in the footsteps of gold, and have been since about April 2022,” but as he argues not in price magnitude but in terms of similar direction and the changes in trend.

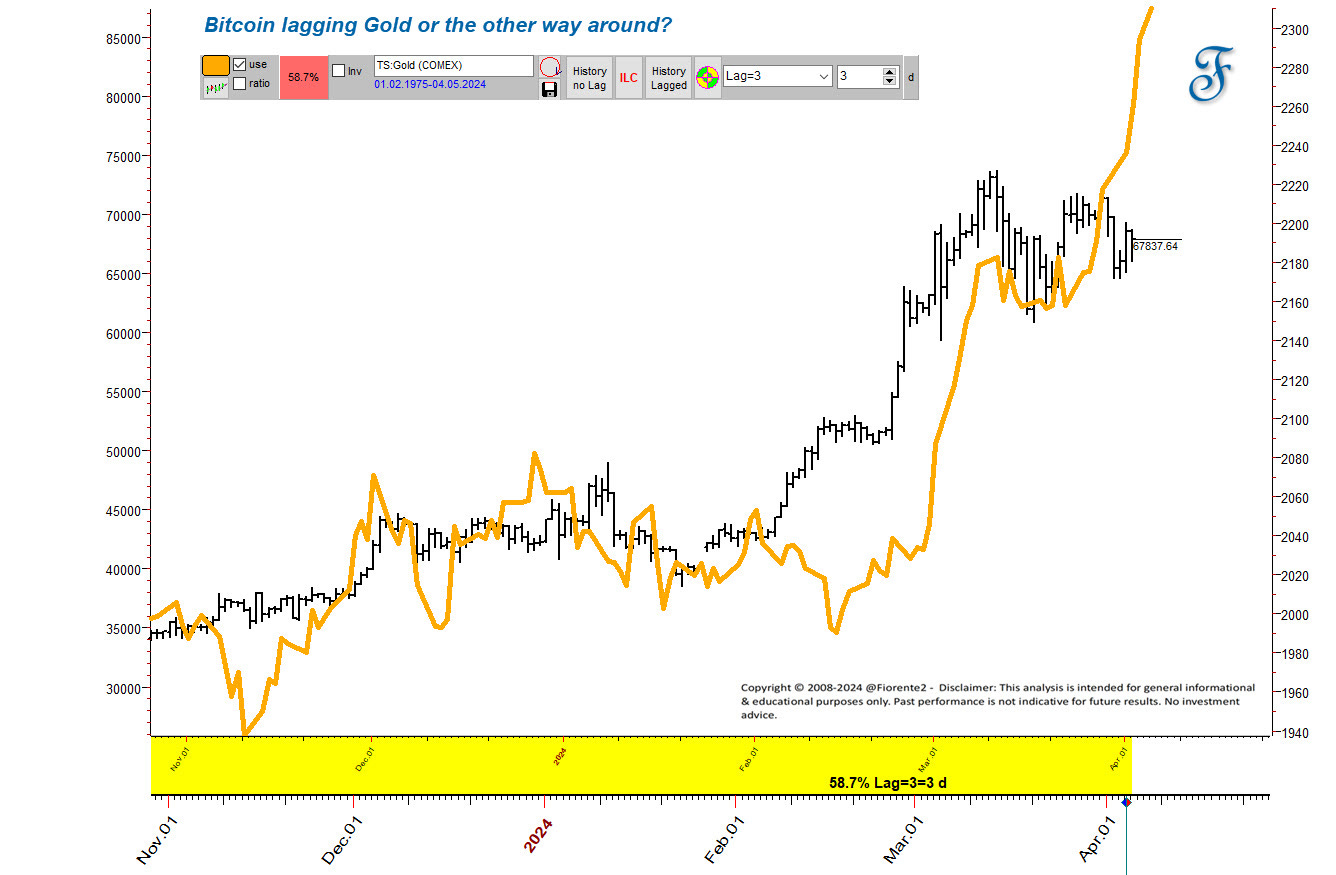

Is there a relationship between Bitcoin and Gold, or is Bitcoin the new digital Gold? McClellan suggests Bitcoin may have been lagging behind Gold for about a week. Doing a similar analysis with Timing Solution software, this is about right. Over the past year, I found that Bitcoin lacked Gold by three days, with a 58.7% correlation.

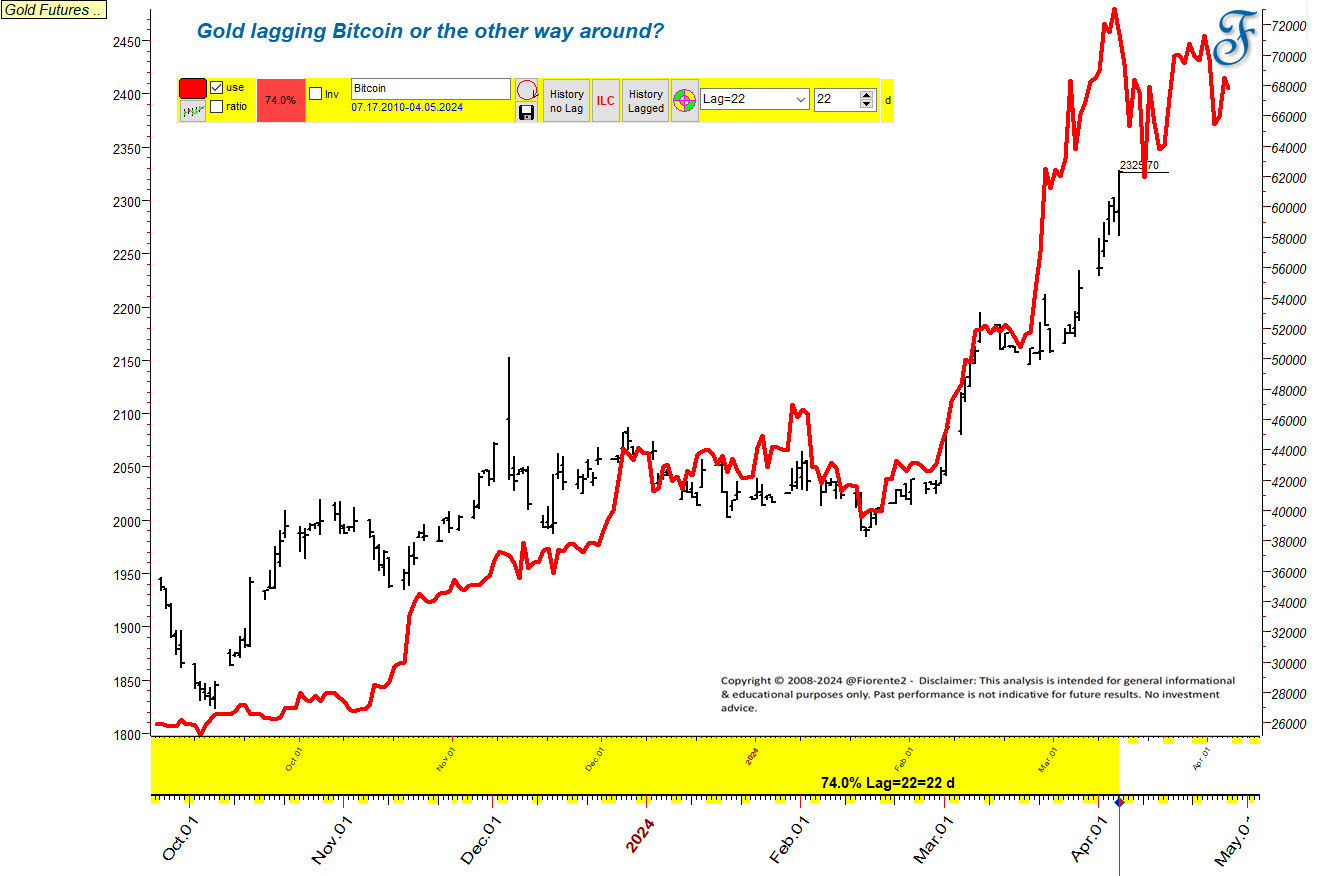

However, from a Gold perspective, Bitcoin may lead gold by 22 days, with a 74% correlation.

The question of which asset is leading - Bitcoin or Gold - is quite intriguing. However, it could be a case of the chicken and egg problem since a higher correlation does not necessarily imply a better correlation. It's important to note that correlation should not be mistaken for causation; at some point, these correlations tend to fade away.

In my opinion, Bitcoin is currently leading Gold. This is because the younger generation has adopted Bitcoin much earlier than the older, more conservative generation. I was reminded of what Peter Atwater wrote on X (Twitter), which states that novice investors are often pulled in at the end of important cycles.

However, a correlation between Bitcoin and Gold may not be due to either asset leading the other; instead, it may result from fundamental, planetary, or Intermarket relationships currently at play. The Mars-Uranus cycle, which is expected to peak this month, maybe the cycle behind the high levels of confidence in both Gold and Bitcoin we are currently experiencing. By analyzing this cycle and other intermarket factors, we may better grasp the possible future movements in Gold and Bitcoin.