Are all risks Off- Dec 15, 2023

#161 - A Gann Master Cycle review and forecast following the DJIA, SPX, Nasdaq Composite & Nasdaq 100

Introduction

I read an article today by a well-known cycle analyst who apologized for not including long-term cycles in his forecast. Through my own experience, I have learned that long-term cycles are crucial in determining the overall direction of financial markets and cannot be ignored.

This is why I follow the Gann Master Cycle, or what is known as the 60-year cycle. W.D. Gann called the Gann Master Cycle – The Great Cycle – The Master Time Factor.

In W.D. Gann’s own words:

“This is the greatest and most important cycle of all, which repeats every 60 years or at the end of the third 20-year cycle. You will see the importance of this by referring to the war period from 1861 to 1869 and the panic following 1869; also, 60 years later- from 1921 to 1929, the greatest bull market in history and the greatest panic in history followed. This proves the accuracy and value of this great time period.”

W.D. Gann referred to a particular cycle as the "Master Cycle" because it corresponds with the 60-year harmonic of the first seven planets, which our days of the week are named after. When this cycle completes, all seven planets will have returned to (nearly) the same zodiac sign.

This indicates that planetary influences may similarly affect human behavior and, consequently, the stock market. Moreover, historical events and societal themes repeat themselves every 60 years. For example, one can compare the current China-Taiwan conflict to the 1962 Russia-Cuba missile crisis.

This cycle can invert, but not so often. It is 3x the Jupiter Saturn cycle of 20 years, discovered by Kepler in 1606. Since 2008, the correlation with past cycle amplitude has deviated from 10-50%, probably due to inversions; hence, the cycle forecast accuracy will vary from time to time. Whenever this cycle inverts, it is worth looking at the 120-year cycle behavior as it is often opposite to the 60-year cycle.

Last year, I cautioned my subscribers and buyers of the yearly publication that the cycle was likely to invert in 2023, and it indeed has done so, maybe even twice. Looking back 60 years, the DJIA was the primary index, but today, the SPX is the leading index, as viewed from the perspective of the 60-year cycle.

The forecast from a year ago indicates that the SPX followed the 60-year cycle, with some instances of inversion. However, this pattern was less noticeable for the DJIA, which I will explain in this post. This could be because the SPX has become the primary index for trading activities.

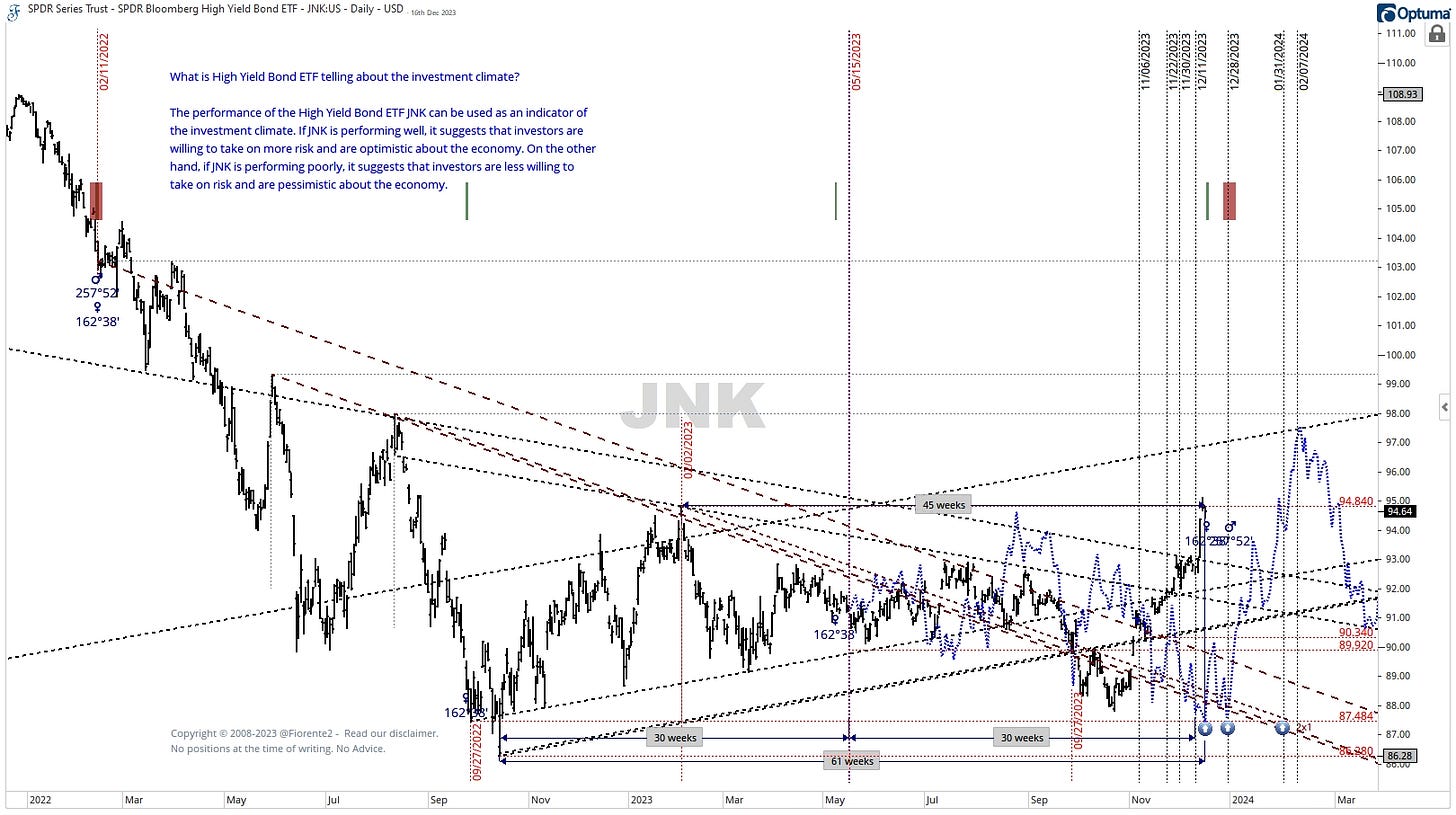

Investors have recently shown a more risk-averse approach towards investing in risky bonds. This may signal their confidence in the economy's prospects.

This may be aligned with the 60-year cycle. However, this does not mean that all risks have disappeared. The markets may be close to a correction.

I always publish the 60-year cycle for the DJIA and the SPX a year ahead in my Annual eBook Publication, the yearly Fiorente2 Stock Market Outlook.

Get ready for Fiorente2 Stock Market Outlook 2024, a digital eBook publication that provides a comprehensive analysis of World Indices, Commodities, Gold, Silver, Oil, Wheat, Treasury Notes, and Crypto Currencies. The publication will feature fully back-tested Mass Pressure Index charts for each equity a full year ahead.

Last year’s owners have already received a pre-order discount link. All free subscribers here on Substack can use the below button/link to pre-order for only $45 USD. A $15 discount on the regular price.

In today’s post, premium subscribers on Substack will be given a promo link (in the below post) for an additional discount. You can easily pay with PayPal or a credit card. Pre-order using the below button/link.

This analysis is intended for general informational & educational purposes only. Hypothetical or simulated performance based on past cycles has many limitations. Cycles can contract, extend, and invert. Anomalies can occur. Hence, past performance is no guarantee for the future. No advice. Please take a look at our full disclaimer.